Content

- What You’ll Need To Open A Business Deposit Account

- Personal Identification

- Deposit Funds And Start Using Your Account

- Business Bank Account Requirements For Startups

- Opening A Business Bank Account With Other Business Products

Opening a business bank account requires proof of identification for both you and your business. Examples include your state-issued driver’s license or passport, your business license or your partnership agreements.However, community banks get higher satisfaction ratings due to more personal customer service, which may make them a worthwhile option for small local businesses. A business bank account establishes your business as its own entity that’s completely separate from your personal finances.

What makes a bank account a business account?

A Business Bank Account Protects Your LLC or Corporation Status. If you have an LLC or corporation, it must have its own bank account in its own name. An LLC or corporation is a separate legal entity from you, so it isn’t proper to put its money into your personal bank accounts even if you’re the sole owner.And if your personal and business finances are mixed, banks won’t have a clear picture of cash flow nor be able to see an income statement. Just like in personal banking, you have several types of business bank accounts to choose from. There are clear advantages to opening a business bank account. For example, managing company cash flow is generally a lot easier when you keep your business and personal finances separate. Also, most online-only accounts are fee-free or allow you to avoid monthly account fees by maintaining a monthly minimum balance. If you’re making out personal checks, they’ll be processed slower.Chase offers a variety of business savings accounts including Total Savings, Premier Savings and a business CD. Compare savings accounts and find the right business savings account for you. This is hugely important at tax time since many expenses can be written off . Using a personal bank account for business makes it much harder to pick out potential deductions. The deposit is the final step to opening the account and making it active. Depending on the bank and type of deposit, funds may not be available immediately. Usually, banks waive them if certain criteria are met, such as maintaining a minimum balance, using bill pay, or keeping within transaction limits.

What You’ll Need To Open A Business Deposit Account

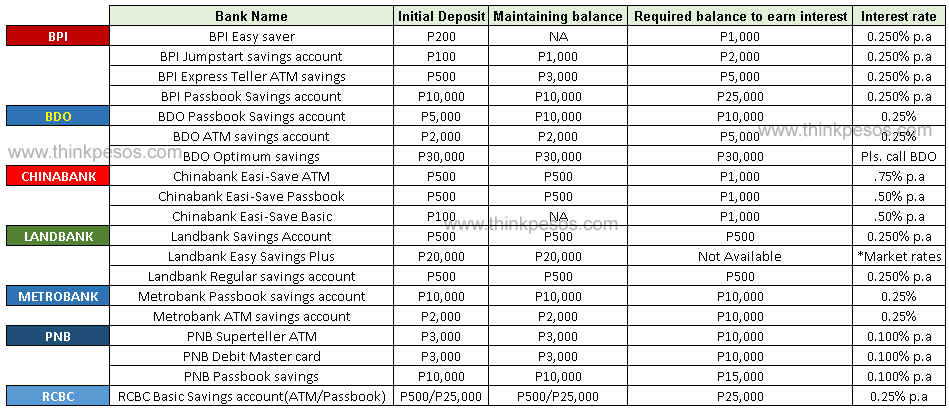

Find out what you need to look for in an applicant tracking system. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Select a business bank account with an initial deposit amount and minimum daily balance that are manageable for your business. Work with your local business banker to identify the amount of your initial deposit.

- She holds a Bachelor’s degree from UC Santa Cruz and a Master’s degree from Mills College.

- This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

- If you’re in person, provide the original documents so the bank representative can make a photocopy.

- “Sometimes banks offer bonuses for opening a business account with them,” she said.

- Businesses interested in opening a merchant services account to process debit and credit card transactions should provide their bank with details of their average monthly credit card revenue.

Now that you’ve chosen a business name, visit your county clerk or state office and pay the required fee to register your business name. This U.S. Small Business Administration guide will tell you where to register. Having a business bank account is a more professional way to run your small business.You do not have to have a separate bank account if you are a sole proprietor. Yet just because it isn’t required doesn’t mean sole proprietorships wouldn’t be wise to open a dedicated business account anyway.

Personal Identification

When speaking with a business banker, make sure to ask which documents the financial institution requires to open a business checking account. On top of this, business bank accounts usually have the option to get a line of credit, which is important in an emergency, according to the SBA. Alternative payment processing services are also popular and connect to your business bank account. If you accept payments online, you can consider online payment systems like PayPal or Shopify. In-person payments can be processed via point-of-sale systems like Square. You may need different business bank accounts for income, payroll and taxes, according to Inc.. Applying at a physical branch of the bank of your choice is the traditional way to open a business checking account.

On the negative side, Bluevine doesn’t have physical branches. If you’re a face-to-face kind of person or your business needs the option to make cash deposits, traditional financial institutions might be better suited to your needs. Business bank accounts are available for all types of businesses. That means you can open a bank account as a sole proprietor, a partnership, an S corp, or a C corp. You might choose a business certificate of deposit, or COD account, to save money at a slightly higher interest rate. The return might be slightly larger with a COD than a typical savings account, but you may be more limited in how you use the money.In either case, you’ll need all those pieces of information and documents we’ve covered above. If you’re applying online, you’ll need to upload those documents. If you’re in person, provide the original documents so the bank representative can make a photocopy. Your Employer Identification Number — If your business is an LLC or corporation, your bank will most likely request your EIN number to open a bank account for your company. Most banks require this information to make sure your business is legitimate. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep.

Deposit Funds And Start Using Your Account

You won’t get in trouble with the government if you don’t have separate bank accounts. But you risk hearing from the IRS if you mixed your personal and business money in a single account and can’t calculate the information you need at the end of the year to file taxes. It’s a common question when you start a new business or realize that your business has expanded beyond what your personal accounts can handle. It’s always a good idea to separate your personal life from your business life, especially when money is involved. If you have a business, no matter how small, it’s good financial practice to open a business bank account. A business bank account allows checks to be made out to the business – which is more professional than asking customers to make out checks to your name. Your customers can also pay with credit cards, and employees can handle banking tasks on behalf of the business.

Can I set up a business bank account without an LLC?

You don’t need to be an established LLC or corporation to open a business bank account. … Sole proprietors may only need to provide a tax ID or Social Security number, while corporations may need to submit more extensive documentation.Another great option that earns the runner-up spot from Nav for best business checking account is Chase. Like Bank of America, Chase’s Business Complete Banking account does come with a fee ($15 in this case). However, customers can qualify for a fee waiver in a number of ways. If you are a sole proprietor, as far as the IRS and the federal government is concerned, you don’t have to separate business and personal money in the bank. But you are obligated to report business income and accurately file your taxes, which means you need to track your business income and expenses very carefully.

Business Bank Account Requirements For Startups

From payment processingto foreign exchange, Chase Business Banking has solutions and services that work for you. Find and apply for the Ink business credit card best suited for your business.If your local area requires a business license, you’ll need a copy to give to the bank. The license will verify that you’re legitimate in business and are complying with the laws regarding running a business. If your business is structured as a separate entity, such as a limited liability company or a corporation, you’ll also need to provide a copy of your charter or articles of incorporation. Most banks provide the option to open a business bank account in person at a branch location or online.

Merchant Services

A government-issued photo ID, such as a driver’s license or passport. We believe everyone should be able to make financial decisions with confidence. The list below will help you quickly and easily determine the documents needed. Based on your business type, you will need one of the following or the appropriate documents issued by a government agency. It’s important to consider the unique needs of your business before choosing a bank. Learn more about the differences between national and community banks by readingour guide. When readers purchase services discussed on our site, we often earn affiliate commissions that support our work.It also makes it much easier to track your income and expenses, according to Inc.. Although you’ve provided your Social Security, the bank will want a picture ID to verify you are who you say you are. If you run your business from home, it can verify your address as well. If your business is run outside of the home, a bill or other official document with your business address can be used to show proof of address. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. You may prefer to visit a branch to receive face-to-face customer service. Online-only accounts typically offer a customer service phone number or live chat.Money you put into a business COD account is locked in, along with the interest rate, for the term of the COD. Sweeney added that most banks require a certified copy of a DBA to open a business bank account, since entrepreneurs aren’t allowed to use their personal bank account under their business name. What you need to open a business bank account will vary depending on your type of business entity, the state you live in, and where your business was established. Once you’ve established your personal and business identities, you may need to make an initial deposit to open your account. Initial deposits and minimum balances vary by bank and account type. Have your business’s paperwork ready when you go to open a bank account. If you have filed documents or licenses on the state level, you might need to bring them as well.

Opening A Business Bank Account With Other Business Products

Sole proprietors may be able to use their social security number in lieu of an EIN. Contact your chosen bank to see what paperwork you’ll need to provide to open your account. Business names that are different from the owner’s given name require the filing of a fictitious name statement. It may also be called a doing-business-as or assumed name statement. Bring a copy of the statement for the bank to verify that the local government and community has been notified about the business and who owns it.