Content

- How Do You Account For Customer Deposits?

- An Inside Look At Bank Of America Corporation Bac

- How The Deposit Accounting Affects Accounts

- How To Convert Bank Deposits To Revenue In Accounting

- Recording A Received Deposit

- Definition Of Unearned Revenue In Accounting

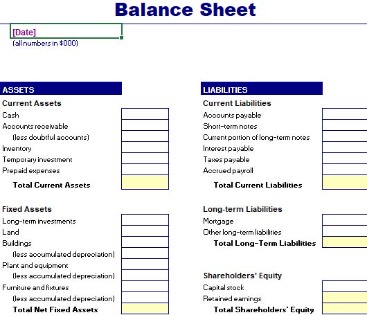

This means that you credit the cash account, but you debit your Prepaid Expenses account. A customer deposit is money from a customer to a company before the company earns it. It is a simple cycle whereby when the company receives cash from a customer and in return, they need to supply goods and services or return the money. ABC Company’s accountant then deposits this check into the bank account on the same day, Dec. 31.

What is consumer deposit account?

Consumer deposit account means a deposit account held in the name of one or more natural persons and used by him, her, or them primarily for personal, family, or household purposes.Maturity gap is a measurement of interest rate risk for risk-sensitive assets and liabilities. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. In essence, this allowance can be viewed as a pool of capital specifically set aside to absorb estimated loan losses. This allowance should be maintained at a level that is adequate to absorb the estimated amount of probable losses in the institution’s loan portfolio.

How Do You Account For Customer Deposits?

Any income or expense that does NOT relate to days between these two dates, MUST be excluded, otherwise the results in the reports will be WRONG. In the second example, you will only ever earn this money if and when you do indeed deliver the promised goods or services. In the first example, you own the cash, because you have done the work, so you have “earnt” the income.

- Income under this category includes bank account and service fees, trust income, loan and mortgage fees, brokerage fees and wealth management services income, and income from trading operations.

- Record that the invoice has been created and apply the deposit amount.

- Regardless of the reasons behind down payments, accounting for them correctly is important.

- Looking at the income statement above, we see that the loan-loss provision ultimately reduced the bank’s net income or profit.

- Below you will learn how to account for customer deposits, whether you are making or receiving a deposit for an order.

- Although we won’t delve into how rates are determined in the market, several factors drive rates including monetary policy set by the Federal Reserve Bank and the yields on U.S.

- This means that you credit the cash account, but you debit your Prepaid Expenses account.

He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. Think of a Customer Deposits account as a holding account for the money. Include a brief description for each transaction you enter into the journal. For example, “paid cash for down payment on sewing machinery, January, 2015.” Create an account called “Down Payments” or “Prepaid Expenses” in your accounting journal.This will decrease the customer’s accounts receivable balance and increase its cash and cash equivalent line item on the company’s balance sheet. It will also be included in the ending cash figure on ABC Company’s statement of cash flows. Sometimes a business needs to make a deposit of cash up front when placing a business-to-business order. There may also be times when you are the seller and have agreed to let your customer make a deposit on an order and to pay the balance after you deliver the goods or services.Unearned Revenue holds the money until it has been earned; in this case, the money will be earned once the rug maker has completed the rug. A transit item is any check or draft that is issued by an institution other than the bank where it was initially deposited. Gross interest is the annual rate of interest to be paid on an investment, security, or deposit account before taxes or other charges are deducted.

An Inside Look At Bank Of America Corporation Bac

When the rug maker finishes the rug and you pick it up, you pay the balance due of $750. For the rug maker, he can now debit Unearned Revenue for $750 ; he can debit Cash for $750 and then he can credit Revenues for the full $1,500. Now that you have your rug and you have paid the remaining balance, you can debit Office Expense for $1,500 and credit Cash and Prepaid Expenses for $750 each. Book balance is an accounting record of a company’s cash balance reflecting all transactions and must be reconciled with the bank account balance. If there areinsufficient fundsin the account on which it’s drawn, the transit item will not clear. In some cases, a bank may agree to cash a transit item before it has cleared, but if it does not clear, the bank will then debit the amount from the depositor’s account to cover the discrepancy.

You’ll notice the balance sheet items are average balances for each line item, rather than the balance at the end of the period. Average balances provide a better analytical framework to help understand the bank’s financial performance.When the goods ordered are so expensive for the company to produce that it requires a deposit from the customer to pay for the production of the goods. Let’s assume that Ace Manufacturing Inc. agrees to produce an expensive, custom-made machine for one of its customers. Ace requires that the customer pay $50,000 before Ace begins to design and construct the machine.Credit risk is the likelihood that a borrower will default on a loan or lease, causing the bank to lose any potential interest earned as well as the principal that was loaned to the borrower. As investors, these are the primary elements of risk that need to be understood when analyzing a bank’s financial statement. To absorb these losses, banks maintain an allowance for loan and lease losses. Also, as interest rates rise, banks tend to earn more interest income on variable-rate loans since they can increase the rate they charge borrowers as in the case of credit cards. However, exceedingly high-interest rates might hurt the economy and lead to lower demand for credit, thus reducing a bank’s net income.

How The Deposit Accounting Affects Accounts

The $50,000 payment is made in December 2020 and the machine must be finished by March 31, 2021. The $50,000 is a down payment toward the machine’s price of $400,000. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. They may have trading liabilities, which consists of derivative liabilities and short positions. K.A. Francis has been a freelance and small business owner for 20 years.

Both interest bearing and non-interest bearing accounts are included. Although deposits fall under liabilities, they are critical to the bank’s ability to lend. In the above table, BofA earned $58.5 billion in interest income from loans and investments while simultaneously paying out $12.9 billion in interest for deposits . The total income earned by the bank is found on the income statement.

How To Convert Bank Deposits To Revenue In Accounting

When the rug maker enters this transaction into the accounting system, he will debit Cash and credit Unearned Revenue for $750. A transit item is any check or draft that is issued by an institution other than the bank where it is to be deposited. Transit items are separated from internal transactions involving checks that were written by a bank’s own customers. Transit items are submitted to the drawee’s bank through either direct presentation or via a localclearing house.

The only way that will be applicable is after goods are delivered, and the deposit becomes a sales transaction. If you are the business that ordered the rug for your office, you also must record the journal entry for the deposit, because this was a business expense. You agreed to pay $750 as a deposit on the rug, and you agreed to pay the balance when the rug was completed.A negative float is the difference between checks written against and deposited in an account and those that have cleared according to bank records. Total interest earned was $57.5 billion for the bank from their loans and all investments and cash positions. The bottom of the table shows the interest expense and the interest rate paid to depositors on their interest-bearing accounts. The Purpose of a Security Deposit The security deposit helps you cover damages, excessive wear and tear, unpaid rent or other unmet conditions of the lease. It also acts as an incentive for the tenant to pay rent on time and avoid damaging the property. This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia.

Recording A Received Deposit

She has been writing about personal finance and budgeting since 2008. She taught Accounting, Management, Marketing and Business Law at WV Business College and Belmont College and holds a BA and an MAED in Education and Training.

What is the journal entry for a deposit?

Debit the cash account for the total amount of the deposit. Credit the applicable sales or service revenue account for the total amount of the deposit. Specify the bank account to which the deposit is being made in the “Name” section of the transaction if using accounting software.For example, a customer asks a retailer to reserve a tuxedo for him, to be picked up a month later; the retailer requires payment of a customer deposit before it will agree to hold the suit. The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. You’ve paid money toward a rug that you do not yet have, so technically, it’s not an expense yet. But your cash account has decreased, and this has to be reflected in your records. Just as Unearned Revenues holds revenues that have not yet been earned, Prepaid Expenses holds an expense that hasn’t yet occurred. If a rug maker agrees to weave a rug made with alpaca yarn for $1,500, then he might ask for half down, or $750 to start, with the remaining $750 to be paid upon completion.

Example Of A Customer Deposit

There is also a corresponding interest-related income, or expense item, and the yield for the time period. In December 2020 Ace will debit Cash for $50,000 and will credit Customer Deposits, a current liability account. When the machine is completed in 2021, Ace will debit Customer Deposits for $50,000 and will credit Sales Revenues for $50,000. The main operations and source of revenue for banks are their loan and deposit operations. Customers deposit money at the bank for which they receive a relatively small amount of interest. The bank then lends funds out at a much higher rate, profiting from the difference in interest rates.After completion, the company will then debit customer deposits and credit sales revenue with the same amount. Deposits is a current liability account in the general ledger, in which is stored the amount of funds paid by customers in advance of a product or service delivery. Otherwise, the seller is at risk of loss if the customer cancels its order prior to delivery. Companies that have their clients send payments directly to their bank do not deal with this timing issue because the company is made aware of deposits when they are posted to their bank account. For companies that collect their own payments, in order to construct accurate financial statements, accountants must often reconcile timing differences caused by factors such as deposits in transit. Banks take indeposits from consumers and businesses and pay interest on some of the accounts.

Definition Of Unearned Revenue In Accounting

First, it most likely shows that the customer has the ability to pay for the product or service they want. Second, it provides cash flow so that the business can buy the supplies and equipment necessary to complete the project. In short, the deposit acts as a good faith investment in the project from both parties.