Content

- What Is The Purpose Of A Journal Entry?

- What Are Debits And Credits?

- Advantages Of General Journal

- What Is The Difference Between Entries In A General Journal Versus A General Ledger?

- Thoughts On general Journal

- What Are Journal Entries For?

3, 2021Invoice #123($600)The money is being removed from accounts receivable—your client doesn’t owe you $600 anymore—so it’s listed as a credit . Going through every transaction and making journal entries is a hassle. But with Bench, all of your transaction information is imported into the platform and reviewed by an expert bookkeeper. No manually inputting journal entries, thinking twice about categorizing a transaction, or scanning for missing information—someone else will do that all for you. It is common to leave some space at the left-hand margin before writing the credit part of the journal entry. As two aspects of a transaction are recorded in the journal, there is no chance of committing a mistake when writing to the ledger. The process of recording transactions in the journal is referred to as journalizing.

What are the 4 commonly used special journals?

Special journals are designed as a simple way to record the most frequently occurring transactions. There are four types of Special Journals that are frequently used by merchandising businesses: Sales journals, Cash receipts journals, Purchases journals, and Cash payments journals.The journal entry may also include a reference number, such as a check number, along with a brief description of the transaction. Every transaction your business makes requires journal entries.For example, MyToys Manufacturing transfers cash from its main account to a subsidiary. A transfer journal entry accounts for the transfer of the money from one account to another. No third party is involved in these entries, and transfers must always net zero. There are two equal and opposite accounts for all the transactions, namely credit and debits. Hence, when a transaction records in a journal, it debits one account and credits the other. Each transaction a company makes throughout the year is recorded in its accounting system.

What Is The Purpose Of A Journal Entry?

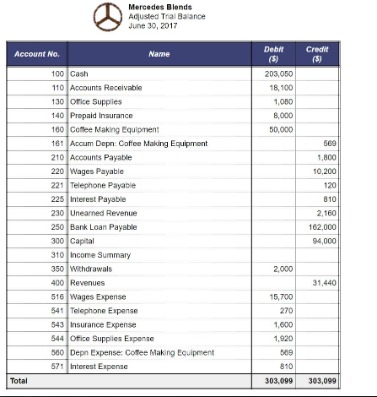

These records can be used for taxation, audit, and evaluation purposes. Accumulated DepreciationThe accumulated depreciation of an asset is the amount of cumulative depreciation charged on the asset from its purchase date until the reporting date.

The advantage is the General Journal provides a more comprehensive view of the transactions you have entered in all your accounts. The General Journal is an advanced register used to enter transactions without needing to open individual accounts.Journal can be of two types – specialty journal and a general journal. If you fall into the second category, let Bench take bookkeeping off your hands for good. If you use accrual accounting, you’ll need to make adjusting entries to your journals every month. At the end of the financial year, you close your income and expense journals—also referred to as “closing the books”—by wiping them clean. That way, you can start fresh in the new year, without any income or expenses carrying over. This column is used to record the amounts of the accounts being debited. These days most of the companies use some form of software package that automates many tasks involved in journalizing their business transactions.

What Are Debits And Credits?

General journal entries are made to record the financial transactions of the University. They are made in a double-entry system, according to Generally Accepted Accounting Principles , where debits equal credits.All journal entries are periodically posted to the ledger accounts. In the posting reference column, the page number of the ledger account to which the entry belongs is written. It’s important to prepare journal entries properly to ensure transactions are accurately recorded. If you use accounting software, you’ll need to make fewer journal entries because automation embedded in the software will flow relevant data to other accounts and reports as needed.

Advantages Of General Journal

Then, credit all of your expenses out of your expense accounts. For the sake of this example, that consists only of accounts payable. When you make a payment on a loan, a portion goes towards the balance of the loan while the rest pays the interest expense.

- The first step in the accounting process is to analyze each transaction and identify what effect it has on the accounts.

- Transfer entries move, or allocate, an expense or income from one account to another.

- Finally, enter the debit or credit amount for each account in the appropriate columns on the right side of the journal.

- The process of recording in the journal is called journalizing.

- An individual trader or a professional fund manager can form a journal where he records the details of the trades made during the day.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

What Is The Difference Between Entries In A General Journal Versus A General Ledger?

The recording of journal entries needs to follow the debit and credit roles. For example, expenses are increasing in debit, and revenues are increasing in credit. Sometimes, the general journal is called the book of original entries. This is because all of this book initially records all of the business’s financial transactions before moving into other books. As accounting grows in complexity and journal entries grow in number, tracking becomes more difficult, especially in manual entry systems. Accounting software is a better solution for the majority of companies because much of the effort around journal entry tracking, pulling and allocating to accounts can be automated. Transfer entries move, or allocate, an expense or income from one account to another.

Examples of transactions recorded in the general journal are asset sales, depreciation, interest income and interest expense, and stock sales. T-accounts are a visual representation of the general ledger account.The same as a general journal, the special journal is used in the manual accounting system only. If the entity uses a system to records its accounting transaction, there is no special journal use. When an accountant book the transactions, and the authorized person approves it, that transaction will directly affect the general journal, general ledgers, trial balance, and general ledgers. An expense accrual refers to an expense reported in an accounting period before it is actually paid. An example is electricity used by a plant in the month before the utility issues a bill for the company to pay. These entries mark the end of an accounting period at a balance that can then be transferred from a temporary account to a permanent one, or from one accounting period to the next.

Thoughts On general Journal

After these relatively few transactions are recorded in the general journal, the amounts will be posted to the accounts indicated. In manual accounting information systems, a variety of special journals may be used, such as a sales journal, purchase journal, cash receipts journal, disbursement journal, and a general journal. The transactions recorded in a general journal are those that do not qualify for entry in any special journal used by the organisation, such as non-routine or adjusting entries. Journal entries are made in chronological order and follow the double-entry accounting system, meaning each will have both a credit and a debit column. Even when debits and credits are linked to multiple accounts, the amounts in both columns must be equal. For example, say a company spends $277.50 catering lunch for employees.

In the case of temporary accounts, the closing entry zeros out the account, and any balance above that is transferred to another, more permanent account. Each of the primary six entry types has a specific function in accounting. Together they present a balanced, accurate and objective statement of the company’s financial standing. The first step in the journal entry process is entering the journal header information. For interfaced journals, this will happen in the subsystem where the entry was initially created (i.e., Accounts Payable).This will give the journal approver context as to what the journal entry is. Has been made easy with all the information being stored in a single repository with no specialty journals in use. It is shown as the part of owner’s equity in the liability side of the balance sheet of the company. You can’t just erase all that money, though—it has to go somewhere.The general journal contains entries that don’t fit into any of your special journals—such as income or expenses from interest. This is why the general ledger is also called the original book of entries, chronological book, or daybook. In the journal, two aspects of every transaction are recorded, following the double-entry system of accounting.

Want A Free Month Of Bookkeeping?

There are many different journals that are used to track categories of transactions like the sales journal, all company transaction are recorded in the general journal. Recording a transaction in the books of accounts is known as making an entry. When a transaction is recorded in the journal, it is known as a journal entry. The general journal is the book that entity firstly records all of the daily financial transactions in it. It is also called a book of original entries because all of the transactions are records in this book before moving to other books. To move data to the proper place in the general ledger, journal entries must be easily trackable so the information can be found and copied as needed. Multiple journal entries can be recorded and tracked in T-accounts, which help finance teams visualize entries for easier review.It is written once per page (i.e., it does not have to be repeated for every entry on the page). This posting is shown by noting both the controlling account number in the post reference column and the subsidiary ledger account number. The first entries for this example are related to cash transactions that shareholders inject into the entity for investment capital. That is the reason why we can see there is a debit to cash and credit to capital. Entering transactions in the General Journal is more complicated than entering them in the individual account registers.Accurate and complete journals are also essential in the auditing process, as journal entries provide detailed accounts of every transaction. Auditors, both internal and external, will look for entries or adjustments that lack the proper documentation, explanations or approvals or that are outside the norm for the business. Journal entries are the foundation of effective record-keeping. The purpose of a journal entry is to physically or digitally record every business transaction properly and accurately.