Content

- Calculating The Interest Coverage Ratio

- Understanding The Interest Coverage Ratio

- What Is A Good Interest Coverage Ratio?

- The Most Crucial Financial Ratios For Penny Stocks

- Interest Coverage Ratio

- Interpreting The Interest Coverage Ratio

Most investors may not want to put their money into a company that isn’t financially sound. If a company has a low-interest coverage ratio, there’s a greater chance the company won’t be able to service its debt, putting it at risk of bankruptcy. In other words, a low-interest coverage ratio means there is a low amount of profits available to meet the interest expense on the debt. Also, if the company has variable-rate debt, the interest expense will rise in a rising interest rate environment.

- Other industries, such as manufacturing, are much more volatile and may often have a higher minimum acceptable interest coverage ratio of three or higher.

- Generally, a higher coverage ratio is better, although the ideal ratio may vary by industry.

- One such variation uses earnings before interest, taxes, depreciation, and amortization instead of EBIT in calculating the interest coverage ratio.

- Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker.

- Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

The interest coverage ratio measures a company’s ability to handle its outstanding debt. It is one of a number of debt ratios that can be used to evaluate a company’s financial condition. The term “coverage” refers to the length of time—ordinarily, the number offiscal years—for which interest payments can be made with the company’s currently available earnings. In simpler terms, it represents how many times the company can pay its obligations using its earnings. What constitutes a good interest coverage varies not only between industries but also between companies in the same industry. Generally, an interest coverage ratio of at least two is considered the minimum acceptable amount for a company that has solid, consistent revenues.

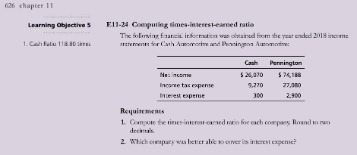

Calculating The Interest Coverage Ratio

Because these industries are more prone to these fluctuations, they must rely on a greater ability to cover their interest in order to account for periods of low earnings. For one, it is important to note that interest coverage is highly variable when measuring companies in different industries and even when measuring companies within the same industry. For established companies in certain industries, such as a utility company, an interest coverage ratio of two is often an acceptable standard. Two somewhat common variations of the interest coverage ratio are important to consider before studying the ratios of companies. If a company’s ratio is below one, it will likely need to spend some of its cash reserves in order to meet the difference or borrow more, which will be difficult for the reasons stated above. Otherwise, even if earnings are low for a single month, the company risks falling into bankruptcy. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader.In corporate finance, the debt-service coverage ratio is a measurement of the cash flow available to pay current debt obligations. The term “coverage” refers to the length of time—ordinarily the number of fiscal years—for which interest payments can be made with the company’s currently available earnings. A bad interest coverage ratio is any number below one as this means that the company’s current earnings are insufficient to service its outstanding debt. Companies need to have more than enough earnings to cover interest payments in order to survive future, and perhaps unforeseeable, financial hardships that may arise. A company’s ability to meet its interest obligations is an aspect of its solvency and is thus an important factor in the return for shareholders. The interest coverage ratio is calculated by dividing earnings before interest and taxes by the total amount of interest expense on all of the company’s outstanding debts. A company with very large current earnings beyond the amount required to make interest payments on its debt has a larger financial cushion against a temporary downturn in revenues.

Is High times interest earned ratio good or bad?

The times interest earned ratio can provide a measure of a company’s overall solvency. Investment bankers and lenders use the TIE ratio (and other solvency ratios) to determine whether a company can use its current income to shoulder additional debt or whether it needs to quickly ramp up profits and improve liquidity.The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. The interest coverage ratio is calculated by dividing a company’s earnings before interest and taxes by its interest expense during a given period.

Understanding The Interest Coverage Ratio

This is an important figure not only for creditors, but also for shareholders and investors alike. If it has trouble doing so, there’s less of a likelihood that future creditors will want to extend it any credit. Return on Capital Employed is a financial ratio that measures a company’s profitability and the efficiency with which its capital is employed. One such variation uses earnings before interest, taxes, depreciation, and amortization instead of EBIT in calculating the interest coverage ratio. Because this variation excludes depreciation and amortization, the numerator in calculations using EBITDA will often be higher than those using EBIT. Since the interest expense will be the same in both cases, calculations using EBITDA will produce a higher interest coverage ratio than calculations using EBIT.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. EBITDA-to-interest coverage ratio is used to assess a company’s financial durability by examining its ability to at least pay off interest expenses. Return on sales is a financial ratio used to evaluate a company’s operational efficiency.

What Is A Good Interest Coverage Ratio?

For example, if a company’s earnings before taxes and interest amount to $50,000, and its total interest payment requirements equal $25,000, then the company’s interest coverage ratio is two—$50,000/$25,000. Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits.

What does a negative Times Interest Earned ratio Mean?

It helps the investors determine the organization’s leverage position and risk level. read more, and Times interest earned ratio often. The negative ratio indicates that the Company is in serious financial trouble.This has the effect of deducting tax expenses from the numerator in an attempt to render a more accurate picture of a company’s ability to pay its interest expenses. Because taxes are an important financial element to consider, for a clearer picture of a company’s ability to cover its interest expenses, EBIAT can be used to calculate interest coverage ratios instead of EBIT. The “coverage” in the interest coverage ratio stands for the length of time—typically the number of quarters or fiscal years—for which interest payments can be made with the company’s currently available earnings.Coverage ratios measure a company’s ability to service its debt and meet its financial obligations. A solvency ratio is a key metric used to measure an enterprise’s ability to meet its debt and other obligations. Similarly, both shareholders and investors can also use this ratio to make decisions about their investments.He has 8 years experience in finance, from financial planning and wealth management to corporate finance and FP&A. A workers’ strike is another example of an unexpected event that may hurt interest coverage ratios.

The Most Crucial Financial Ratios For Penny Stocks

Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook. Chip Stapleton is a Series 7 and Series 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana.A company barely able to meet its interest obligations with current earnings is in a very precarious financial position, as even a slight, temporary dip in revenue may render it financially insolvent. Furthermore, while all debt is important to take into account when calculating the interest coverage ratio, companies may choose to isolate or exclude certain types of debt in their interest coverage ratio calculations. As such, when considering a company’s self-published interest coverage ratio, it’s important to determine if all debts were included. Cash available for debt service is a ratio that measures the amount of cash a company has on hand to pay obligations due within a year. Other industries, such as manufacturing, are much more volatile and may often have a higher minimum acceptable interest coverage ratio of three or higher. The ratio is calculated by dividing EBIT by the company’s interest expense—the higher the ratio, the more poised it is to pay its debts.

Types Of Interest Coverage Ratios

The interest coverage ratio is used to measure how well a firm can pay the interest due on outstanding debt. You can use this formula to calculate the ratio for any interest period including monthly or annually. Generally, a higher coverage ratio is better, although the ideal ratio may vary by industry. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A lower ratio may be unattractive to investors because it may mean the company is not poised for growth.

In contrast, a coverage ratio below one indicates a company cannot meet its current interest payment obligations and, therefore, is not in good financial health. Lenders, investors, and creditors often use this formula to determine a company’s riskiness relative to its current debt or for future borrowing. A ratio above one indicates that a company can service the interest on its debts using its earnings or has shown the ability to maintain revenues at a fairly consistent level. While an interest coverage ratio of 1.5 may be the minimum acceptable level, two or better is preferred for analysts and investors. For companies with historically more volatile revenues, the interest coverage ratio may not be considered good unless it is well above three. Another variation uses earnings before interest after taxes instead of EBIT in interest coverage ratio calculations.

Interest Coverage Ratio

The ratio is calculated by dividing EBIT by interest on debt expenses during a given period, usually annually. Because of such wide variations across industries, a company’s ratio should be evaluated to others in the same industry—and, ideally, those who have similar business models and revenue numbers. The lower the ratio, the more the company is burdened by debt expenses and the less capital it has to use in other ways. When a company’s interest coverage ratio is only 1.5 or lower, its ability to meet interest expenses may be questionable. These include white papers, government data, original reporting, and interviews with industry experts. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.Like any metric attempting to gauge the efficiency of a business, the interest coverage ratio comes with a set of limitations that are important for any investor to consider before using it. Moreover, the desirability of any particular level of this ratio is in the eye of the beholder to an extent. Some banks or potential bond buyers may be comfortable with a less desirable ratio in exchange for charging the company a higher interest rate on their debt. Staying above water with interest payments is a critical and ongoing concern for any company. As soon as a company struggles with its obligations, it may have to borrow further or dip into its cash reserve, which is much better used to invest in capital assets or for emergencies. Some variations of the formula use EBITDA or EBIAT instead of EBIT to calculate the ratio.Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. A high ratio indicates there are enough profits available to service the debt, but it may also mean the company is not using its debt properly. For example, if a company is not borrowing enough, it may not be investing in new products and technologies to stay ahead of the competition in the long-term. J.B. Maverick is a novelist, scriptwriter, and published author with 17+ years of experience in the financial industry. For example, during the recession of 2008, car sales dropped substantially, hurting the auto manufacturing industry.