Content

- Difference Between Notes Payable And Accounts Payable

- Notes Payable Vs Accounts Payable

- Note Payable In Accounting

- Creating An Enforceable Promissory Note

- Notes Payable

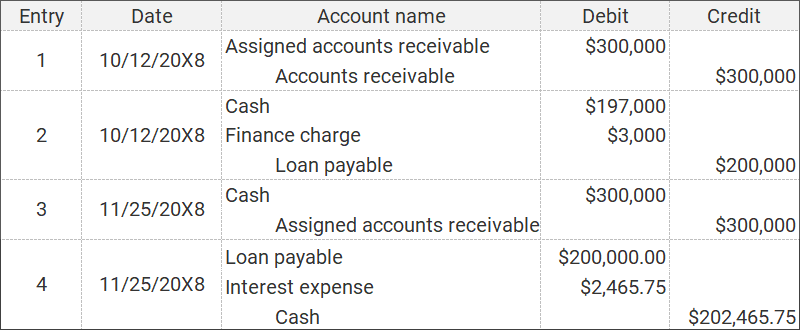

Accounts payable may be converted into notes payable upon agreement between a company and its vendor. In many cases, a company may be restricted from paying dividends or performing stock buybacks until the promissory note has been repaid. When a company flies out its employees to attend a convention or meeting, the travel expenses and accommodations are often booked under accounts payable. These liabilities, also known as accounts, represent the money that a business owes to its vendors and lenders for services and supplies rendered. This article will definitely help me to understand notes payable well. It is within an organization’s best interest to keep the overall cash conversion cycle in check and ensure that all liabilities are honored per their commitment. Notes payable can be short-term or long-term obligations for the business.The company will record this loan in its general ledger account, Notes Payable. In addition to the formal promise, some loans require collateral to reduce the bank’s risk. Generally, accounts payable do not require a written document or note to specify the terms and conditions. However, an invoice issued by the seller is attached to each order. If the terms and conditions of the note are agreed upon between the company and the Creditor, the note is written, signed, and issued to the creditor. Notes Payable and Accounts Payable are different because Notes Payable are based on written promissory notes, while Accounts Payable are not.

- The amounts of money involved are often much higher and for riskier investments, like buying a new business property.

- The maker then records the loan as a note payable on its balance sheet.

- The agreement may also require collateral, such as a company-owned building, or a guarantee by either an individual or another entity.

- The signature of the person who issued the note with the date signed.

- The interest rate may be fixed over the life of the note, or vary in conjunction with the interest rate charged by the lender to its best customers .

This typically happens if a company decides it’s unable to fulfill its short-term debt obligations. Receiving a significant loan from a bank or other financial institution.Notes Payable is the name of the account that a bookkeeper or accountant uses when documenting the borrowing of money. The general ledger account keeps track of the amount owed and any payments made towards the principal of the loan. General ledgers in accounting track all of the major accounts and are used to provide the information used in financial reporting.

Difference Between Notes Payable And Accounts Payable

Any business loan payments and outstanding amounts should be marked on the balance sheet as part of the notes payable account. Here’s a closer look at what the notes payable account is, and what function it serves in business accounting. Notes Payable is a ledger account prepared by an accountant for recording transactions that involve borrowing of money. This is the most effective way of recording the transactions relating to amount borrowed and on which interest is to be paid.

Notes payable, in contrast, can be classified as either a short-term or long-term liability. The company issuing the promissory note and its lender may agree to a due date longer than one year ahead.

Notes Payable Vs Accounts Payable

When a company issues promissory notes, it maintains the records of the amount of promissory notes issued in a ledger account. Under these, the lender lends the money at an agreed interest to a borrower who promises to pay back the amount within a stipulated time or on a pre-decided date. As you repay the loan, you’ll record notes payable as a debit journal entry, while crediting the cash account. But you must also work out the interest percentage after making a payment, recording this figure in the interest expense and interest payable accounts.Debts marked under accounts payable must be repaid within a given time period, usually under a year, to avoid default. There are rarely ever fixed payment terms or interest rates involved. The items purchased and booked under accounts payable are typically those that are needed regularly to fulfill normal business operations, such as inventory and utilities. Additionally, they are classified as current liabilities when the amounts are due within a year.

Accounts payable is always used in working capital management and has an impact on an organization’s cash conversion cycle. Notes payable, however may or may not be included as part of a company’s cash flow management.

Note Payable In Accounting

To run their day-to-day business operations, companies often take on short-term liabilities to maintain an adequate amount of working capital. Todd borrow $100,000 from Grace to purchase this year’s inventory.

Both parties will enter a verbal agreement on when the amount is expected to be paid. The company must have paid back the initial principal plus the specified interest rate by the note’s maturity date. Tim wants to start his business and as he does so he begins to look for financing. He goes to the bank and signs a note for $10,000 with an interest rate of 6%. The note is due in exactly one year which Tim believes will be enough time to get his business off the ground. This is the principal amount of $10,000 plus the 6% interest over the year which equals $600.The amount not due within one year of the balance sheet date will be a noncurrent or long-term liability. Often a company will send a purchase order to a supplier requesting goods. When the supplier delivers the goods it also issues a sales invoice stating the amount and the credit terms such as Due in 30 days. After matching the supplier’s invoice with its purchase order and receiving records, the company will record the amount owed in Accounts Payable. Notes payable is a non-operational debt that represents written obligations to creditors in exchange for funds.

Creating An Enforceable Promissory Note

Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. Under the accrual method of accounting, the company will also have another liability account entitled Interest Payable. In this account the company records the interest that it has incurred but has not paid as of the end of the accounting period. That arrangement converts an account payable into a note payable. Journalizing a transaction means that the accounts payable account is debited and the notes payable account is credited. The balance in the notes payable account represents the total amount that still needs to be paid against all promissory notes the company has issued.

How does notes payable affect the financial statement of a business?

Increase in Notes Payable When a business takes on a new loan or note, it increases the notes payable account on the balance sheet. This boosts its cash flow because it received money from the loan. A business reports this amount as a cash inflow in the financing activities section of the cash flow statement.Thepayee, on the other hand records the loan as a note receivable on its balance sheet because they will receive payment in the future. If a company borrows money from its bank, the bank will require the company’s officers to sign a formal loan agreement before the bank provides the money.

Notes Payable

An example of a notes payable is a loan issued to a company by a bank. On the other hand, accounts payable typically represent amounts due to suppliers and vendors of a company. The $40 monthly interest would be recorded as a credit to the cash account and as a debit to interest payable.The lender may require restrictive covenants as part of the note payable agreement, such as not paying dividends to investors while any part of the loan is still unpaid. If a covenant is breached, the lender has the right to call the loan, though it may waive the breach and continue to accept periodic debt payments from the borrower. The agreement may also require collateral, such as a company-owned building, or a guarantee by either an individual or another entity. Many notes payable require formal approval by a company’s board of directors before a lender will issue funds. Short-term notes payable are those promissory notes which are due for payment within 12 months from the date of issue. On balance sheet, these are represented as short term liability.

Are payables assets or liabilities?

Accounts payable is considered a current liability, not an asset, on the balance sheet.Notes due within the next 12 months are considered to be current or short-term liabilities, while notes due after one year are long-term or non-current liabilities. The account Notes Payable is a liability account in which a borrower’s written promise to pay a lender is recorded.

The Two Categories For Notes Payable Are

For most companies, if the note will be due within one year, the borrower will classify the note payable as a current liability. If the note is due after one year, the note payable will be reported as a long-term or noncurrent liability.Notes payable is a written promise to pay a certain amount at some future date. The account appears on the balance sheet when the company borrows money and signs a note or contract stating they will repay the amount plus interest. Both notes payable and accounts payable are considered current liabilities but both accounts differ in several ways. Both liabilities have a relative impact on an organization’s overall liquidity and as such need to be managed both responsibly and efficiently. The majority of accounts payable has to be settled within 12 months and is recorded as a current liability in the balance sheet.By contrast, recording liabilities in accounts payable doesn’t always take interest into account, nor does it involve formal promissory notes. Instead, you simply enter each individual item on the liability side of the balance sheet. Notes payable is a liability account written up as part of a company’s general ledger. It’s where borrowers record their written promises to repay lenders. By contrast, the lender would record this same written promise in their notes receivable account. When you take out a loan, it’s important to manage your payments carefully.