Content

- Pro Forma Balance Sheet

- Historical With Acquisition Pro Forma Projection

- History Of Pro Forma

- Why Create Pro Forma Statements?

One of the most used features on QuickBooks Online is the invoice tool. We’ll show you how to create an invoice, make recurring invoices, send reminders, and more. I’d advise Russel to hire a part-time assistant to reduce the risk of sinking nearly $60,000 into a new position when he’s not sure he’ll see the increased revenue he’s expecting. He can always offer the person a full-time job after his projection actualizes. Businesses create annual budgets that fall in line with a company’s profitability and production goals. Get clear, concise answers to common business and software questions.This pro forma projection is useful to investors and lenders, who want reassurance that your business is slated for profitability. However, this restructuring charge is a one-time extraordinary item, and is not part of the company’s normal business operations. So, in order to show investors and other interested parties what the company’s income statement would have looked like without that one-time restructuring charge, the company included a proforma version of the income statement in its annual report. Prepare your pro forma income statement using data you’ve compiled in the prior four steps.

Pro Forma Balance Sheet

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. …plan for the future, by considering best, worst, and most likely case scenarios in detail. Pro forma is actually a Latin term meaning “for form” (or today we might say “for the sake of form, as a matter of form”). First off, you’ll need to set a sales goal for the period you’re looking into. Cash available for distribution is a real estate investment trust’s cash-on-hand that is available to be distributed as shareholder dividends.In law, pro forma court rulings are intended merely to facilitate the legal process . This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.With the passage of the Sarbanes-Oxley Act of 2002, modifying accounting and disclosure statements, the SEC has begun issuing new requirements related to pro forma statements. Most specifically, the SEC has found that pro forma statements, which are not required to follow Generally Accepted Accounting Principles , may give a false impression of the company’s actual financial status.

What is pro forma in real estate?

In real estate, pro forma is a document that helps investors evaluate a property’s potential profit. A real estate pro forma report details a property’s projected net operating income (NOI) and cash flow projections using its current and potential rental income and operating expenses. …The dot-com bubble, where tech companies enjoyed bloated market valuations before losing it all, proved the harm of pro forma financials. In the early 2000s, Yahoo caught heat after years of releasing pro forma financial statements that downplayed hefty one-time costs from business acquisitions. The Securities and Exchange Commission consistently updates its stringent rules on preparing pro forma statements for the public. Still, pro forma financials are not regulated to the same extent as historical financial statements. The purchase of a sole proprietorship, partnership, Sub-Chapter S corporation, or business segment requires pro forma statements for a series of years in order to reflect adjustments for such items as owners’ or partners’ salaries and income taxes.

Historical With Acquisition Pro Forma Projection

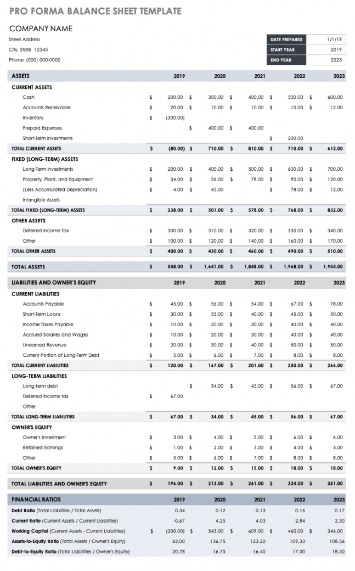

Then, add assets, owner’s equity, and total liabilities to complete the pro forma balance sheet. First, you should transfer the change in retained earnings from your pro forma statement of income across to the balance sheet.

In many cases, pro forma statements are prerequisites for investment. Statements of estimated taxable operating results and cash to be made available by operations are required in pro forma statements for real estate and leasing operations. These should be pro forma statements of the registrant, rather than of the property, giving effect to the acquisition.The following adjustments generally are not appropriate on the face of the respective pro forma financial statements, but could be disclosed in the footnotes thereto. If the outcome of minimum or maximum participation does not have a pervasive impact on the financial statements, possible outcomes and their impacts may be discussed in a note to the pro forma financial statements. Pro forma presentation should be based on the latest balance sheet included in the filing. A pro forma balance sheet is not required if the acquisition or disposal is already reflected in a historical balance sheet.

History Of Pro Forma

In accounting, pro forma refers to financial reports based on assumptions and hypothetical situations, not reality. Businesses use pro forma financial documents internally to aid in decision-making and externally to showcase the effect of business decisions. If management considers a flexible budget most appropriate for its company, it would establish a range of possible outcomes generally categorized as normal , above normal , and below normal . Management examines contingency plans for the possible outcomes at input/output levels specified within the operating range.Here’s a real-life example of a pro forma income statement, courtesy of Tesla Inc.’s unauditedpro forma condensed and consolidated income statement for the year ended December 31, 2016. Pro forma financials have their place, but some public companies have taken advantage of loose rules to mislead potential investors. They have multiple uses for multiple scenarios, ranging from simple sales growth projections to more intricate M&A or investment purposes. Whatever you’re using them for, just make sure that you’re organized, detailed, and accurate throughout. Otherwise, you’re limiting the insights that you’re creating the pro formas for in the first place. And if it all seems a bit much, Embarkis always around to swoop in and save the day.

Why Create Pro Forma Statements?

You may want to create financial projections for different investment amounts to cover your bases. If you plan to acquire another business, this is the right pro forma statement for you.

- Therefore, it’s important to be cautious when evaluating these sorts of financial statements and use them alongside other financial documents to get a clearer picture of the business’s actual finances.

- See Topic 2 for definition of a business and tests of significance.

- International Financial Reporting Standards are a set of accounting rules currently used by public companies in 166 jurisdictions.

- Pro forma financial statements essentially forecast the future.

- The provision of S-X 3-14 which permits estimated taxable operating results of real estate companies to include annualization of existing lease contracts is not applicable to equipment leasing companies or other businesses that generate income through leases.

- Because companies’ definitions of pro forma will vary along with their internal methods for forecasting and making assumptions, you must be careful when comparing pro forma figures between different companies.

If actual interest rates in the transaction can vary from those depicted, disclosures of the effect on income of a 1/8 percent variance in interest rates should be disclosed. If amortization of purchase adjustments is not straight‑line, the effect on operating results for the five years following the acquisition should be disclosed in a note, if material. The effects of additional financing necessary to complete the acquisition. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management.The invoice will typically describe the purchased items and other important information, such as the shipping weight and transport charges. A pro forma invoice requires only enough information to allow customs to determine the duties needed from a general examination of the included goods. Your costs, on the other hand, will include items such as lease expense, utilities, employee pay, insurance, licenses, permits, materials, taxes, etc. Be sure to put a great deal of thought into each expense and keep your estimates realistic. Calculate the estimated revenue projections for your business, a process called pro forma forecasting. Use realistic market assumptions and not just numbers that make you or your investors feel optimistic.Pro forma presentation may be necessary to reflect operations and financial position of the registrant as a stand-alone entity. A change in the business entity resulting from the acquisition or disposition of an asset or investment, and/or the pooling of interests of two or more existing businesses. Your balance sheet’s closing cash balance is the sum of the previous period’s closing cash and the current period’s cash from operations, financing activities, and investing. So your business is chugging right along, and you’ve had great financial results for years. You have no problem proving to a potential investor or lender that your company is doing well. Maybe you’re selling off part of the company, or acquiring another.For this reason, SEC requires that all pro forma statements be accompanied with forms that do conform to GAAP, the company required to select those versions of formal statements most closely resembling the pro forma. During the course of the fiscal period, management evaluates its performance by comparing actual results to the expectations of the accepted plan using a similar pro forma format. Management’s appraisal consists of testing and re-testing the assumptions upon which management based its plans. In this way pro forma statements are indispensable to the control process.

A pro forma financial statement is one based on certain assumptions and projections . It may be tempting to think of a pro forma statement as the same as a business budget. After all, you create both in anticipation of the future. But budgets and pro forma statements are two distinct financial tools. GAAP is a common set of generally accepted accounting principles, standards, and procedures that public companies in the U.S. must follow when they compile their financial statements.We put the “pro forma” label on these financial documents because there’s a lot of “what if” involved in their making. Management also uses this procedure in choosing among budget alternatives. Planners present sales revenues, production expenses, balance sheet and cash flow statements for competing plans with the underlying assumptions explained. Based on an analysis of these figures, management selects an annual budget. After choosing a course of action, it is common for management to examine variations within the plan.

Financing Or Investment Pro Forma Projection

But according to the good folks at Merriam-Webster, hypothetical means “involving or being based on a suggested idea or theory.” Put another way, pro formas use information that can vary substantially from actual data. So while they’re extremely helpful at looking at events from different angles, never take them as gospel, only well-informed conjecture. In some countries, customs may accept a pro forma invoice if the required commercial invoice is not available at the time when filing entry documents at the port of entry to get goods released from customs. The U.S. Customs and Border Protection, for example, uses pro forma invoices to assess duty and examine goods, but the importer on record is required to post a bond and produce a commercial invoice within 120 days from the date of entry.Finally, calculate the total cash payments, net cash change, and end cash position to arrive at your completed pro forma cash flow statement. If necessary adjustments include only taxes, pro forma presentation for all periods presented is encouraged, but not required. Pro forma adjustments that give effect to actions taken by management or expected to occur after a business combination, including termination of employees, closure of facilities, and other restructuring charges. Forecasts or projections may be the most appropriate way to depict the effect of such actions.Management also should disclose how the pro forma statement of comprehensive income is not indicative of operations going forward because it necessarily excludes various operating expenses. Material assumptions also should be fully explained in a note. If factually supportable, certain adjustments may demonstrate the effects of the changes in operations that may have affected historical revenues or operating expenses had they been implemented at the beginning of the historical period.