Content

- Schedule C Tips And Tricks

- Business Checking Accounts

- Accounting

- Schedule C Example

- What Other Forms May Need To Be Completed Outside Of A Schedule C? Hint: Schedule Se

Rely on our team of small business certified tax pros to get your taxes right and keep your business on track. Find out how Block Advisors can help with your small business taxes.She is a graduate of Washington University in St. Louis. This is where you explain how you valued your inventory. Most small businesses will use the Cost method . If you’re using cash accounting, this is the only way to value your inventory.

Schedule C Tips And Tricks

This makes filling out your Schedule C far easier. Before you try to tackle Schedule C on your own, consider using one of the business tax software programs available, either online or in download form. They will walk you through a set of questions to make sure you don’t miss anything important.

What mileage can I deduct for Instacart?

The Standard IRS Mileage Deduction: You can deduct a fixed rate of 56 cents per mile in 2020. For 2020, the rate was 57.5 cents per mile. This rate covers all the costs of operating your vehicle, like gas, depreciation, oil changes, and repairs. It’s typically the best option for most Instacart shoppers.You cannot deduct fines, penalties, and most entertainment expenses. You report all fines, penalties, and entertainment expenses. You must follow the IRS modified accelerated cost recovery system depreciation system.Is where you report your business expenses. There are over a dozen categories to help you stay organized, such as advertising, car and truck expenses, legal and professional services, rent, travel and meal expenses and other costs. For independent contractors, filing taxes is a little more complicated. Contractors don’t have an employer, so they’re responsible for paying taxes and reporting their income. 1099 contractors must use IRS Form 1040 to report income. However, Form 1040 includes additional requirements for 1099 contractors.Section 23 includes all taxes you paid, such as sales tax, payroll tax, and property tax. You can also deduct all fees paid for business licenses. Enter the total cost of contract labor for the tax year. Contract labor includes payments to persons you pay for business-related services who are not considered employees . These would be people for whom you supplied 1099 forms. Section 8 is where you put the total amount spent on advertising for your business.

Business Checking Accounts

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Here is a list of our partners and here’s how we make money. If you freelance, have a side gig, run a small business or otherwise work for yourself, you may need to file a Schedule C at tax time. Loans from $5,000 – $100,000 with transparent terms and no prepayment penalty. Tell us a little about yourself, your business and receive your quote in minutes without impacting your credit score.

Please see this article on PPP loans for more information. The purpose of this section is to report the income in your business. It’s also where you will calculate your gross profit and your gross income.

Accounting

Price for Federal 1040EZ may vary at certain locations. One state program can be downloaded at no additional cost from within the program. Most state programs available in January; release dates vary by state. Make estimated quarterly tax payments to avoid penalties.

- Below is a sample Profit and Loss report from QuickBooks Online that provides the information necessary to complete Schedule C.

- Is a place to list other business expenses that didn’t fit into the categories in Part II.

- Although you’ll likely need to purchase the highest-end version to get Schedule C functionality, that still might end up costing less than paying someone else to do your taxes.

- Section 37 is the cost of labor, not including any amounts paid to yourself.

- You will have to see the instructions for Schedule C to determine your investment.

- Single-member LLCs are business entities owned by just one person.

This part of Schedule C is going to help you to calculate your gross income, or the total amount of money you made before taxes or other deductions. First, calculate your business’s income. If you use Sharing Economy apps like Airbnb, Uber, or Upwork, you can view an annual revenue report on your profile. Be sure to include gross earnings as you will deduct any commissions in the ‘expenses’ portion of your Schedule C. Some expenses are difficult to categorize on a tax return. This is a place for miscellaneous expenses like petty cash on your business tax return, so don’t hesitate to include all of these hard-to-categorize items. This process will give you a net income or loss amount for your business.Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. US Mastercard Zero Liability does not apply to commercial accounts .That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team.

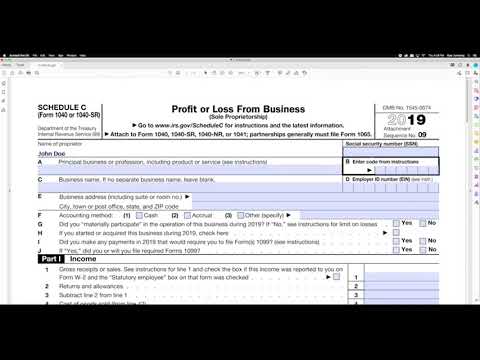

Schedule C Example

The most laborious section of Schedule C comes in Part 2, where you enter your small business tax deductions. Most of the amounts you enter will mirror the account balances in your accounting software, but there are a few differences. You know there’s going to be a difference between your book and tax expenses when the words “see instructions” appear on any line of Schedule C. QuickBooks will ensure your books stay organized, and it can track your vehicle mileage. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return.

What is C form and H form?

‘H Form’ under CST is issued when the inter-state buyer is an exporter and buys the goods for the purpose of exports. If the exporter buyer (who belong to other state) issues ‘H form’, the selling dealer is not required to charge or pay any CST on the transaction.Use this complete list of Business Tax Deductions from A to Z to make sure you didn’t miss a deduction. Business expenses that you can deduct are listed alphabetically on lines 8 through 27.

What Other Forms May Need To Be Completed Outside Of A Schedule C? Hint: Schedule Se

You may have to file Form 461 Limitation on Business Losses if you have a business loss. Meal expenses may only be deductible at 50%. Entertainment expenses are no longer deductible. A single-member LLC business pays tax using Schedule C if the business has not elected to pay tax as a corporation or S corporation. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer.

Section 37 is the cost of labor, not including any amounts paid to yourself. Section 33 is about the methods used to value closing inventory. Your inventories can be valued at cost, the lower of cost, or market. If you have a loss, check the box that describes your investment in this activity. You will have to see the instructions for Schedule C to determine your investment. Office expenses could include writing implements, stamps, printer paper, maybe even a printer. This section will detail your business’s expenses.A husband-wife business organized as a partnership may become a Qualified Joint Venture and pay tax using two Schedule C forms instead of using the more complicated partnership form. There are restrictions and qualifications for this election. IRS Forms 940 and 941 must be filled out to ensure you’re paying employment taxes. We discuss the difference in each form and how to fill them out accurately. TaxAct Self-Employed is part of TaxAct’s suite of tax preparation applications that are available online, or as a download that can be installed on your desktop or laptop computer.

Get The Latest On Monthly Child Tax Credit Payments Here

Or take a live, small business tax workshop or webinar. Option A involves completingForm 8829, by calculating the total area of your home and getting a percentage for your home business. Include the total allowable expenses resulting from those calculations on line 30 of Schedule C.