Content

- Definition Of Accounts Receivable

- An Account Payable Is Another Company’s Account Receivable

- Is Accounts Payable A Debit Or A Credit Or Both?

- Definition Of An Accounts Payable Debit

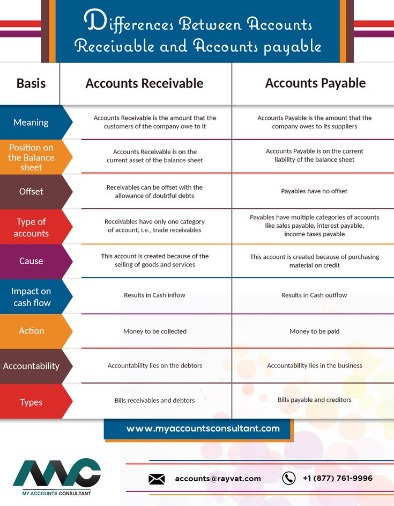

- What Is The Difference Between Accounts Payable And Accounts Receivable?

- What Is An Account Payable?

The account Notes Payable is a liability account in which a borrower’s written promise to pay a lender is recorded. (The lender record’s the borrower’s written promise in Notes Receivable.) Generally, the written note specifies the principal amount, the date due, and the interest to be paid. The following table highlights the symmetry between a company’s account payable and its vendor’s account receivable.

What is GL code in invoice?

A General Ledger Code (GL Code) is a string of alphanumeric characters assigned to each financial entry in an organization’s ledger. A GL Code can indicate basic information such as a debit or credit by location or provide highly specific details about an entry through a GL String.Our Accounts Payable Cheat Sheet defines the terminology used in the accounts payable function of a business. To learn more about the various aspects of accounts payable, see our Explanation, Quiz, Q&A, and more.

Definition Of Accounts Receivable

To safeguard its assets, every company should have internal controls to avoid duplicate payments and to avoid payments for fraudulent vendor invoices or invoices containing incorrect amounts. Some vendor invoices allow for early-payment discounts, such as 1/10, net 30. These credit terms mean that a company can deduct 1% from the amount owed if the amount is paid within 10 days instead of the normal 30 days. For most companies, if the note will be due within one year, the borrower will classify the note payable as a current liability. If the note is due after one year, the note payable will be reported as a long-term or noncurrent liability.The estimated amount is reported as a credit balance in a contra-receivable account such as Allowance for Doubtful Accounts. This credit balance will cause the amount of accounts receivable reported on the balance sheet to be reduced. Any adjustment to the Allowance account will also affect Uncollectible Accounts Expense, which is reported on the income statement. An account payable is an amount owed to a supplier or vendor for goods or services that were provided in advance of payment. However, some people use the term only if the amount is already recorded in the general ledger account Accounts Payable. (Until it is, they refer to the amount as one of the company’s accrued liabilities.) For others, it is an account payable even if it is not yet recorded in Accounts Payable. The term accounts payable can also refer to the person or staff that processes vendor invoices and pays the company’s bills.

An Account Payable Is Another Company’s Account Receivable

In addition to the formal promise, some loans require collateral to reduce the bank’s risk. Our Explanation of Accounts Payable provides insights on the bill paying process in a large company. Included are discussions of the three-way match, early payment discounts, end of period accruals, and more. We now offer 10 Certificates of Achievement for Introductory Accounting and Bookkeeping. The accrual of obligations and expenses that have not yet been completely processed.

When the amount of the credit sale is remitted, Company B will debit its liability Accounts Payable and will credit Cash. Company A will debit Cash and will credit its current asset Accounts Receivable. If a promissory note is involved, the account Notes Payable will be used instead of Accounts Payable. If a company borrows money from its bank, the bank will require the company’s officers to sign a formal loan agreement before the bank provides the money. The company will record this loan in its general ledger account, Notes Payable.

Is Accounts Payable A Debit Or A Credit Or Both?

The adjusting entry will credit a liability account and will usually debit an expense or asset account as of the final day of the accounting period. To avoid any double counting when the actual invoice gets processed, a reversing entry is often processed on the first day of the next accounting period. As is expected for a liability account, Accounts Payable will normally have a credit balance. Hence, when a vendor invoice is recorded, Accounts Payable will be credited and another account must be debited (as required by double-entry accounting). When an account payable is paid, Accounts Payable will be debited and Cash will be credited. Therefore, the credit balance in Accounts Payable should be equal to the amount of vendor invoices that have been recorded but have not yet been paid. If the company owes for goods and services and the amounts are not yet recorded in Accounts Payable, they must be entered with an adjusting entry at the end of the accounting period.

The credit portion of the adjusting entry is likely to be recorded in a separate current liability account such as Accrued Expenses and Liabilities. The title of the current liability account containing the amounts owed for vendor invoices and other bills that have been approved but not yet paid. Accrued Expenses Payable is a liability account that records amounts that are owed, but the vendors’ invoices have not yet been received and/or have not yet been recorded in Accounts Payable as of the end of the accounting period. The amounts in this account are usually recorded with accrual adjusting entries made at the end of the accounting period. Good accounting requires that an estimate should be made for any amount in Accounts Receivable that is unlikely to be collected.

Definition Of An Accounts Payable Debit

The credit balance indicates the amount that a company or organization owes to its suppliers or vendors. The efficiency and effectiveness of the accounts payable process will also affect the company’s cash position, credit rating, and relationships with its suppliers. Under the accrual method of accounting, the company receiving goods or services on credit must report the liability no later than the date they were received.

Which is better Higher AP or higher AR?

A lower Accounts Payable (AP) bodes better for the business. A higher Accounts Receivable (AR) shows good signs of financial health. The Accounts Payable(AP) of one company could be the A/R of the other.Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. When the supplier delivers the goods it also issues a sales invoice stating the amount and the credit terms such as Due in 30 days. After matching the supplier’s invoice with its purchase order and receiving records, the company will record the amount owed in Accounts Payable.

What Is The Difference Between Accounts Payable And Accounts Receivable?

The same date is used to record the debit entry to an expense or asset account as appropriate. Hence, accountants say that under the accrual method of accounting expenses are reported when they are incurred . The account Accounts Payable is normally a current liability used to record purchases on credit from a company’s suppliers. The amount that the company is owed is recorded in its general ledger account entitled Accounts Receivable. The unpaid balance in this account is reported as part of the current assets listed on the company’s balance sheet. Accounts receivable is the amount owed to a company resulting from the company providing goods and/or services on credit. Accounts receivable is a current asset account in which a company records the amounts it has a right to collect from customers who received goods or services on credit.

- That’s why a supplier who hasn’t received payment from a customer will phone and ask to speak with “accounts payable.”

- The estimated amount is reported as a credit balance in a contra-receivable account such as Allowance for Doubtful Accounts.

- Any adjustment to the Allowance account will also affect Uncollectible Accounts Expense, which is reported on the income statement.

- The efficiency and effectiveness of the accounts payable process will also affect the company’s cash position, credit rating, and relationships with its suppliers.

- The provider of the goods or services is referred to as the supplier or vendor.

An account payable is an obligation that results when a company receives goods or services on credit. The provider of the goods or services is referred to as the supplier or vendor. Accounts Payable is a liability account in which suppliers’ or vendors’ approved invoices are recorded. A section of the accounting department that is responsible for processing vendor invoices and other bills for goods and services that a company received on credit. Since Accounts Payable is a liability account, it should have a credit balance.

What Is An Account Payable?

That’s why a supplier who hasn’t received payment from a customer will phone and ask to speak with “accounts payable.” When a company orders and receives goods in advance of paying for them, we say that the company is purchasing the goods on account or on credit. If the company receiving the goods does not sign a promissory note, the vendor’s bill or invoice will be recorded by the company in its liability account Accounts Payable .If a company pays one of its suppliers the amount that is included in Accounts Payable, the company will need to debit Accounts Payable so that the credit balance is decreased. If a company purchases additional goods or services on credit , the company will need to credit Accounts Payable so that the credit balance will increase accordingly. A manufacturer will record an account receivable when it delivers a truckload of goods to a customer on June 1 and the customer is allowed to pay in 30 days. From June 1 until the company receives the money, the company will have an account receivable .