Content

- Turbotax Online Guarantees

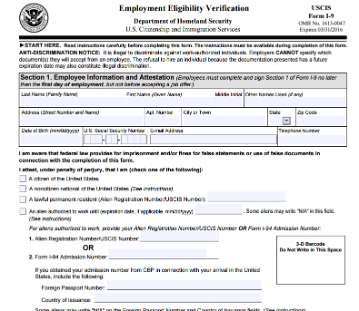

- Employment Tax Obligations

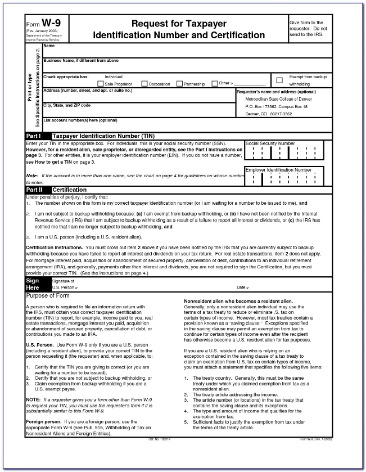

- When Is The Deadline To Collect Irs Form W

- Popular Articles In Returning To Work

- Form 1099

Most taxpayers are not, but if they are, the company hiring the independent contractor will need to withhold income tax from that contractor’s pay at a flat rate of 24% (for tax years 2018–2025) and send it to the IRS. Most employers will pay independent contractors solely non-employee income for services provided, though all the other categories listed qualify as 1099 income if paid out.The IRS requires that you show you made a minimum of three solicitations for the TIN. The contractor or freelancer is subject to a $50 per-attempt fee if they fail to comply. If you’re unable to get the TIN after the three attempts, the IRS requires you withhold 24% from all payments to the contractor or freelancer. You send it to the employers who have requested it from you. While it’s relatively simple to fill out a W-9, always double check to ensure your information is complete and accurate. If you are unsure how to fill something out, consider looking for a tax accountantto help you make sense of your taxes. Again, keep your safety in mind when completing and sending a W-9.

Turbotax Online Guarantees

If you’re a contractor, you only need to fill out a business name if you’ve actually registered one. Otherwise, just fill out the top line and leave this one blank. Employers furnish the Form W-2 to the employee and the Social Security Administration. The Social Security Administration shares the information with the Internal Revenue Service.If you have paid fishing boat proceeds, enter those in box 5. As a limited liability company, also known as an LLC. When readers purchase services discussed on our site, we often earn affiliate commissions that support our work.

Employment Tax Obligations

The number shown on this form is my correct taxpayer identification number . Never use a made-up or someone else’s tax ID number. This one applies to you if you are filing the Form W-9 outside the United States. Check out the IRS’s guide to international business entities for more information. This applies to you if you’re doing business but don’t have a business partner (you’re acting as an individual) and in case you haven’t incorporated your business. Keep in mind this form is only used if you are not hired as an employee. If you are an employee, you need to fill in Form W-4 instead.

Is a w9 for self employed?

W-9 forms are for self-employed workers like freelancers, independent contractors and consultants. You need to use it if you have earned over $600 in that year without being hired as an employee. If your employer sends you a W-9 instead of a W-4, the company has likely classified you as an independent contractor.On the right, you will find a field called “Requester’s name and address”. This is optional, but it could be a good idea to keep track of who you’re sending this Form W-9 to. This applies to you if your business isn’t incorporated but rather has shared ownership with other people. This is a legal document, so it’s important to read and follow all instructions carefully. There’s also no guarantee that the recipient will store the form securely even if you send it securely, so you might want to ask about that in advance. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Sadly, 1099 and W-9 aren’t the only forms you need to keep track of.As an independent contractor or freelancer, you’ll receive a W-9 form when you begin your work from the company using your services. Then in January, you’ll receive your 1099-MISC form that documents your annual earnings. When you file your federal taxes, attach each of the 1099 forms you have received. The company will also file your 1099-MISC with the IRS. The Limited liability company box is for a Partnership or LLC businesses with multiple members. If your LLC has not filed a request to be taxed as a C or S corporation, it is taxed as a Partnership.When documenting non-employee income paid to an independent contractor, the “account number” and “FATCA filing requirement” boxes below the recipient’s address can almost always be left blank. Thefifth page of Form 1099details the limited exceptions. At its most fundamental, the definition of an independent contractor is any person who performs services for your company without being bound to the same requirements as your full-time employees.You’ll also become responsible for calculating and paying your estimated taxes four times a year and filling out Schedule C when you file your annual tax return. Backup withholding is when a paying entity takes 24% of your payment amount in federal income taxes, even though independent contractors are generally responsible for paying their own taxes. In box 3, enter all money paid directly to independent contractors for their services. In previous tax years, a separate box existed for these payments; however, starting in 2020, direct payments to independent contractors are entered in box 3. This box also includes money paid as prizes, research study incentives, punitive damages or anything else not specified by the other boxes. If your entity is exempt from backup withholding, you’ll fill in the first line with your code.

When Is The Deadline To Collect Irs Form W

This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity. A TIN may be either a Social Security Number , or an Employer Identification Number . Make sure the contractor checks the box exempting him from tax withholding.

Workest is here to empower small business with news, information, trends, and community. As an HR Advisor at Zenefits, Lauren provides guidance and best practices to companies of all sizes with any HR and compliance questions.

Popular Articles In Returning To Work

Keep all invoices on file, and make sure they coordinate with Form 1099-MISC. William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification. Max Freedman is a content writer who has written hundreds of articles about small business strategy and operations, with a focus on finance and HR topics. He’s also published articles on payroll, small business funding, and content marketing. In addition to covering these business fundamentals, Max also writes about improving company culture, optimizing business social media pages, and choosing appropriate organizational structures for small businesses.If you are a business, you will provide your employer identification number. If your business is so new that it does not yet have an EIN but you have applied for one, you should write “applied for.” You may even find yourself on the other side of the transaction if you are the one making the payments to an independent contractor. You have a responsibility to obtain the W-9 from the contractor and retain a copy of it; however, it’s not necessary to send it to the IRS. A W-9 form is crucial to filing your taxes if you’re a contract worker, a freelancer or self-employed. The companies you work with do not have to withholdpaycheck taxesfor you, and the W-9 serves as an agreement that you are responsible for paying those taxes on your own. At the end of the tax year, the business you did work for will use the information on your W-9 to complete a1099-MISC.A sole proprietor business operates under the owner’s Social Security number and hasn’t been registered as another type of business. Taxes apply to single-member LLCs in the same way.

- Form W-9 and Form 1099 both streamline the business owner’s workload come tax season.

- That means sending it as an encrypted file attachment.

- The number shown on this form is my correct taxpayer identification number .

- The form may be filed by either the business or the worker.

Check box 7 only if the provided statement is true. In the two boxes below the address box, write your TIN and your recipient’s TIN where indicated. Download Form 1099 from the IRS.gov website to see all required information. To complete the form, sign it with your full name and the date.

Corporation Or Partnership

Employers use this form to get the Taxpayer Identification Number from contractors, freelancers and vendors. The form also provides other personally identifying information like your name and address. An independent contractor who receives an unexpected W-9 should hesitate before filling it out and research whether the requester has a legitimate reason to ask for this form.

If you are exempt from reporting required by the Foreign Account Tax Compliance Act , you will fill in the second line. The latter only applies if you hold your accounts outside the United States. If you maintain your account in the U.S., you can leave the second line blank or write “N/A.” If you’re unsure about your exemptions, Page 3 of the form outlines situations that would make you exempt.

Form 1099

The difference is crucial, as misclassification could result in significant fines and penalties. You expected a Form W-4 instead.If you’re starting a new job and your employer hands you a W-9 to fill out, ask whether you’ll be working as a self-employed independent contractor or as an employee. Employees complete Form W-4, not Form W-9, to set their tax withholdings.You do not need to fill in this section as an individual. Only certain businesses or entities with any reason for exemption need to fill out these spaces.

Who Is Required To Fill Out A W

This is the same penalty levied if you do not to file a 1099 at all. If your business fails to file Form 1099 for any of your contractors, then you can be fined up to $250 for each failed filing. The FATCA code entered on this form indicating that I am exempt from FATCA reporting is correct. If you’re self-employed and have worked for a number of vendors, you’ll have to fill out multiple W-9 forms. Each vendor who paid you more than $600 in a given year will send you a 1099 the following year, by January 31.