Content

- Simple Regression Models

- Integrated Population Biology And Modeling, Part B

- Related Terms

- Overfitting In Regression

- Statistics How To

- Minimum Sample Size

Before proceeding, we must clarify what types of relationships we won’t study in this course, namely, deterministic relationships. In other words, the R-square measure indicates that we can improve our prediction of calories in a beer by almost 84% if we know the alcohol content. The slope term β1×1 specifies how much the line rises for each increase in x. Positive values define lines that slope upward while negative values define lines that slope downward. Options have a high degree of nonlinearity, which may make them seem unpredictable. Learn about nonlinearity and how to manage your options trading risk. Brian Beers is a digital editor, writer, Emmy-nominated producer, and content expert with 15+ years of experience writing about corporate finance & accounting, fundamental analysis, and investing.

Compared to the previous fit, the outlier tends to pull the fitted line up toward the outlying point. In other words, as the model tries to minimize the squared distance between it and every point, a few outlying points tend to exert a disproportionate influence on the model’s characteristics. C.Repeat the procedure in question b using spending as the dependent variable. The last form above demonstrates how moving the line away from the center of mass of the data points affects the slope. As the estimator of the Pearson’s correlation between the random variable y and the random variable x . As a consumer of regression analysis, there are several things you need to keep in mind.

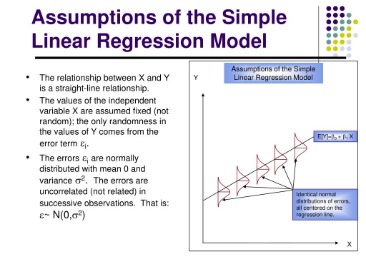

Simple Regression Models

Regression analysis includes several variations, such as linear, multiple linear, and nonlinear. Nonlinear regression analysis is commonly used for more complicated data sets in which the dependent and independent variables show a nonlinear relationship. In statistics, simple linear regression is a linear regression model with a single explanatory variable. The adjective simple refers to the fact that the outcome variable is related to a single predictor. Now that we know how the relative relationship between the two variables is calculated, we can develop a regression equation to forecast or predict the variable we desire.In simple linear regression we assume that, for a fixed value of a predictor X, the mean of the response Y is a linear function of X. We denote this unknown linear function by the equation shown here where b0 is the intercept and b1 is the slope. The regression line we fit to data is an estimate of this unknown function. Multiple regression analysis is almost the same as simple linear regression. The only difference between simple linear regression and multiple regression is in the number of predictors (“x” variables) used in the regression.

But do you know how to parse through all of the data available to you? The good news is that you likely don’t have to do the number crunching yourself (hallelujah!) but you do need to correctly understand and interpret the analysis created by your colleagues. Check out our YouTube channel for hundreds of videos on elementary statistics, including regression analysis using a variety of tools like Excel and the TI-83. When there is multicollinearity in your data, or if the effect size is small.

Integrated Population Biology And Modeling, Part B

P-values, R-Squared and regression coefficients can all be misleading. Ordinary linear regression usually isn’t enough to take into account all of the real-life factors that have an effect on an outcome.

- Then we get that if x is some measurement and y is a followup measurement from the same item, then we expect that y will be closer to the mean measurement than it was to the original value of x.

- As the estimator of the Pearson’s correlation between the random variable y and the random variable x .

- Essentially, the CAPM equation is a model that determines the relationship between the expected return of an asset and the market risk premium.

- Vital lung capacity and pack-years of smoking — as amount of smoking increases (as quantified by the number of pack-years of smoking), you’d expect lung function to decrease, but not perfectly.

- There is another scenario of overfitting, that involves selecting more than the optimal number of independent variables .

- Instead, “You have to go out and see what’s happening in the real world.

This model enables us to predict removal for parts with given outside diameters and widths. In this article, we will explain four types of revenue forecasting methods that financial analysts use to predict future revenues. The beta (β) of an investment security (i.e. a stock) is a measurement of its volatility of returns relative to the entire market. It is used as a measure of risk and is an integral part of the Capital Asset Pricing Model . A company with a higher beta has greater risk and also greater expected returns. It can be utilized to assess the strength of the relationship between variables and for modeling the future relationship between them.We can use regression, and the results of regression modeling, to determine which variables have an effect on the response or help explain the response. We are often interested in understanding the relationship among several variables. For example, if the relationship is curvilinear, the correlation might be near zero. Python and R are both powerful coding languages that have become popular for all types of financial modeling, including regression. These techniques form a core part of data science and machine learning where models are trained to detect these relationships in data.

Related Terms

This section on linear regression can be wrapped up with a brief discussion of several checkpoints to ensure that any models are valid. This is a critical step in the analytics process because all modeling follows the garbage in, garbage out dictum. It is incumbent upon the data scientist to ensure these checks are completed. Thus, we see that along with data on open and closed birth intervals one can get good estimates of PPR, while data on only open birth interval may provide good estimate of TFR.

What is difference between ANOVA and t test?

The Student’s t test is used to compare the means between two groups, whereas ANOVA is used to compare the means among three or more groups. … A significant P value of the ANOVA test indicates for at least one pair, between which the mean difference was statistically significant.Essentially, the CAPM equation is a model that determines the relationship between the expected return of an asset and the market risk premium. With spending as the dependent variable and income as the explanatory variable. Second, “analyses are very sensitive to bad data” so be careful about the data you collect and how you collect it, and know whether you can trust it. “All the data doesn’t have to be correct or perfect,” explains Redman but consider what you will be doing with the analysis.

Overfitting In Regression

When you see a correlation from a regression analysis, you can’t make assumptions, says Redman. Instead, “You have to go out and see what’s happening in the real world. ” Go out an observe consumers buying your product in the rain, talk to them, and find out, what is actually causing them to make the purchase.These additional factors are known as the Fama-French factors, named after the professors who developed the multiple linear regression model to better explain asset returns. There is another scenario of overfitting, that involves selecting more than the optimal number of independent variables . Not all features exert the same influence on the predicted outcome, some features have more influence than others. However, as more features are included in a model, the training error continues to reduce. But the test error may spiral out of control and result in another form of overfitting. In this article, you’ll learn the basics of simple linear regression, sometimes called ‘ordinary least squares’ or OLS regression—a tool commonly used in forecasting and financial analysis.She has expertise in finance, investing, real estate, and world history. Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook. An example of a linear model for the cleaning data is shown below. We have 50 parts with various inside diameters, outside diameters, and widths. This is measured before and after running the parts through the cleaning process. This is the difference between pre-cleaning and post-cleaning measures. Ridge regression tends to push all the weights toward zero in order to minimize the cost function.Multiple regression analysis is used to see if there is a statistically significant relationship between sets of variables. One variable, denoted x, is regarded as the predictor, explanatory, or independent variable. Regression analysis is a widely used statistical technique to explore the relationships between continuous variables. Applications of regression are numerous and occur in almost every field, including from economics, management, life sciences, and the social sciences. In fact, we can state that regression analysis may be one of the most widely used statistical technique.Stepwise regression involves selection of independent variables to use in a model based on an iterative process of adding or removing variables. Multiple linear regression is a statistical technique that uses several explanatory variables to predict the outcome of a response variable. It is also important to distinguish if the outlier is a training object, a validation object, or an unknown object. Training outliers are points of the training set and participate in estimating the regression model.The other variable, denoted y, is regarded as the response, outcome, or dependent variable. In this blog post I did not talk to you about regression analysis assumptions but this should not be take in light mood.We’re interested in whether the inside diameter, outside diameter, part width, and container type have an effect on the cleanliness, but we’re also interested in the nature of these effects. The relationship we develop linking the predictors to the response is a statistical model or, more specifically, a regression model.

What Is Simple Linear Regression?

Regression Analysis is the statistical technique that expresses the relationship between 2 or more variables in a form of equation. In the most simple case involving just two measures , regression can be used to explore and quantify the relation between the two variables. An independent variable is an input, assumption, or driver that is changed in order to assess its impact on a dependent variable .

Minimum Sample Size

The following is based on assuming the validity of a model under which the estimates are optimal. It is also possible to evaluate the properties under other assumptions, such as inhomogeneity, but this is discussed elsewhere. Sometimes factors are correlated that are so obviously not connected by cause and effect but more often in business, it’s not so obvious.