Content

- Definition Of Balance Sheet

- What Is A Trial Balance?

- How Do I Get My P&l And My Balance Sheet To Balance Out?

- What Is The Accounting Cycle?

- What Are The Steps In A Standard Monthly Accounting Closing Cycle?

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.If the difference is divisible by 2, you may have transferred a debit-balanced account to the trial balance as a credit, or a credit-balanced account as a debit. When the difference is divisible by 2, look for an amount in the trial balance that is equal to one-half of the difference. A balance sheet is one of the five financial statements that are distributed outside of the accounting department and are often distributed outside of the company.

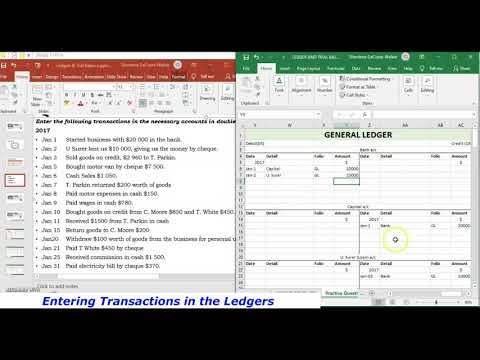

For example, if a cash sale for £100 is debited to the Sales account, and credited to the Cash account. All accounts having an ending balance are listed in the trial balance; usually, the accounting software automatically blocks all accounts having a zero balance from appearing in the report. You can prepare your trial balance at regular intervals to make sure your books are balanced. For example, many organisations use trial balance accounting at the end of each reporting period. The primary job of a bookkeeper is to maintain and record the daily financial events of the company. A Bookkeeper is responsible for recording and maintaining a business’ financial transactions, such as purchases, expenses, sales revenue, invoices, and payments.

Definition Of Balance Sheet

The purpose of a trial balance is to ensure that all debit transactions entered into the general ledger equal all of the credit transactions that have been entered. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Finally, you can prepare a statement of cash flows using information found in any of the accounts that interacts with the cash accounts in the trial balance.Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle.

- Preparing and adjusting trial balances aid in the preparation of accurate financial statements.

- Recording the balance of an account incorrectly in the trial balance.

- Some errors do not cause the trial balance’s column totals to disagree.

- If a balance appears out of the ordinary, review the activity for that account to verify it.

- The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements.

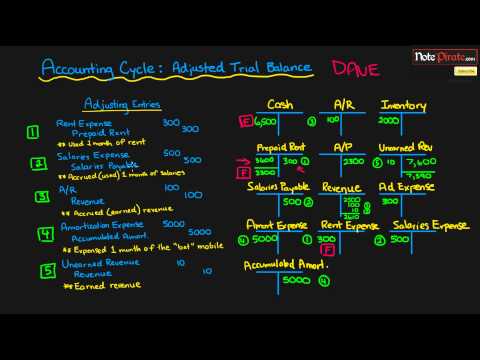

- This additional level of detail reveals the activity in an account during an accounting period, which makes it easier to conduct research and spot possible errors.

Adjusting entries are all about making sure that your financial statements only contain information that is relevant to the particular period of time you’re interested in. Once you’ve double checked that you’ve recorded and added up all of your transactions properly, it’s time to make adjusting entries. It’s hard to understand exactly what a trial balance is without understanding double-entry accounting jargon like “debits” and “credits,” so let’s go over that next.With accounting software, business owners don’t have to wait for the end of the year to make a trial balance and assess their financial information. If the sum of the debit entries in a trial balance (in this case, $36,660) doesn’t equal the sum of the credits (also $36,660), that means there’s been an error in either the recording of the journal entries. The following trial balance example combines the debit and credit totals into the second column, so that the summary balance for the total is zero. Adjusting entries are added in the next column, yielding an adjusted trial balance in the far right column. This additional level of detail reveals the activity in an account during an accounting period, which makes it easier to conduct research and spot possible errors. Alternatively, the parent company may require all of its subsidiaries to use the same accounting system, so that all subsidiary results can be automatically rolled up into consolidated financial statements. In effect, there is no longer a need to use the trial balance report in accounting operations.

What Is A Trial Balance?

As with theaccounting equation, these debit and credit totals must always be equal. If they aren’t equal, the trial balance was prepared incorrectly or the journal entries weren’t transferred to the ledger accounts accurately. A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance.Searching for and fixing these errors is called making correcting entries. Double-entry accounting tracks where your money comes from and where it’s going.

Does trial balance always tally?

Here the ledger form of a trial balance is prepared in the form of an account. With each side of the trial balance having particulars such as (name of the account) column, folio column and the amount column. The trial balance must tally, irrespective of the form of a trial balance.As you can see, all the accounts are listed with their account numbers with corresponding balances. In accordance withdouble entry accounting, both of the debit and credit columns are equal to each other. At this point you might be wondering what the big deal is with trial balances. Did we really go through all that trouble just to make sure that all of the debits and credits in your books balance? You’re now set up to make financial statements, which is a big deal. The trial balance is strictly a report that is compiled from the accounting records.

How Do I Get My P&l And My Balance Sheet To Balance Out?

A trial balance only checks the sum of debits against the sum of credits. The following are the main classes of errors that are not detected by the trial balance. While we still have not prepared financial statements, we have captured the activity and organized it into a trial balance. Next up is editing the information before we can publish our story in financial statements. The following video summarizes what elements are included in a Trial Balance and why one is prepared.This ensures that the balance sheet will follow the accounting principle in double-entry bookkeeping, balancing each debit with a credit. If these debits and credit didn’t match, it would be time to go back to the general ledger and see if any errors were made before this information was recorded on the official balance sheet. By checking that your debits and credits are equal, you can pick up on any mathematical errors. Total debits should equal total credits for the trial balance to be correct. If there are any discrepancies in the totals, you can investigate these problems before they’re recorded on the official financial statements. If debit and credit totals match, you can move on to analyzing ending balances for discrepancies. If the ending debit and credit balances don’t match, you will need to research what accounts are out of balance and make any corrections.

What Is The Accounting Cycle?

Basically, each one of the account balances is transferred from the ledger accounts to the trial balance. All accounts with debit balances are listed on the left column and all accounts with credit balances are listed on the right column.This can also occur due to confusion in revenue and capital expenditure. An error of reversal is when entries are made to the correct amount, but with debits instead of credits, and vice versa.

What are the 4 accounting assumptions?

There are four basic assumptions of financial accounting: (1) economic entity, (2) fiscal period, (3) going concern, and (4) stable dollar.It is primarily used to identify the balance of debits and credits entries from the transactions recorded in the general ledger at a certain point in time. If a balance appears out of the ordinary, review the activity for that account to verify it.The trial balance accounts are listed in a specific order to help in the preparation of financial statements. Before you start off with the trial balance, you need to make sure that every ledger account is balanced. The difference between the sum of all the debit entries and the sum of all the credit entries provides the balance. In a double-entry account book, the trial balance is a statement of all debits and credits.

What Are The Steps In A Standard Monthly Accounting Closing Cycle?

That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. If you use accounting software, this usually means you’ve made a mistake inputting information into the system. Tara Kimball is a former accounting professional with more than 10 years of experience in corporate finance and small business accounting. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. If there is a difference, accountants have to locate and rectify the errors.

The equality of the two totals in the trial balance does not necessarily mean that the accounting process has been error-free. Serious errors may have been made, such as failure to record a transaction, or posting a debit or credit to the wrong account.

Overview: What Is A Trial Balance?

Ideally, the totals should be the same in an error-free trial balance. It is also important to note that even when the trial balance is considered balanced, it does not mean there are no accounting errors. For example, the accountant may have failed to record an account or classified a transaction incorrectly. These are accounting errors that would not show up in the trial balance.All of your raw financial information flows into it, and useful financial information flows out of it. Using information from the asset, liability and equity accounts in the trial balance, you can prepare a balance sheet.Similarly, recording transactions in the wrong accounts does not lead to unequal trial balances. Another common error a trial balance does not catch happens when a single transaction is posted twice. The trial balance is a useful tool, but every transaction must be carefully analyzed, journalized, and posted to ensure the reliability and usefulness of accounting records. If the difference between the debit and credit balance totals is not divisible by 2 or 9, look for a ledger account with a balance that equals the difference and is missing from the trial balance.For instance, if a transaction involving payment of a $ 100 account payable is never recorded, the trial balance totals still balance, but at an amount that is $ 100 too high. A trial balance is a report that lists the ending balance of all of your general ledger accounts. Used to ensure that debits and credits match, a trial balance serves as a way to check for posting errors and out-of-balance accounts. The totals equal $8,500 on both sides for the accounting period in question, meaning the books are balanced.