Content

- Correcting Entries With Reversals

- News From The Wall Street Journal

- Link To Learning

- What Is The Difference Between Adjusting Entries And Correcting Entries, And, Expenses And Payments?

- Understanding The Cash Flow Statement

- Who Needs To Make Adjusting Entries?

Supplies Expense would increase for the $100 of supplies used during January. For the sake of balancing the books, you record that money coming out of revenue.

- With an adjusting entry, the amount of change occurring during the period is recorded.

- An accrued expense is recognized on the books before it has been billed or paid.

- An operating cycle consists of lead time, production time, sales time, delivery time, and cash-collection time.

- And it will likely generate financial statements for you.

- Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received.

- AccountDebitCreditCash$150Accounts Receivable$150To fix the entries, find the difference between the correct amount and the mistaken entry.

- For example, going back to the example above, say your customer called after getting the bill and asked for a 5% discount.

As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months. You should make adjustments to cash when reconciling bank statements. This allows for clear documentation, such as the bank statement, to justify the change in the cash accounting. You can make error-correction entries in cash accounts. These should be carefully documented, and reasons for the cash correction should be made clear. Accounting for your small business must be very clear.

Correcting Entries With Reversals

Kevin Johnston writes for Ameriprise Financial, the Rutgers University MBA Program and Evan Carmichael. Label each of the following as a deferral or an accrual, and explain your answer. The equipment purchased on January 5 depreciated $75 during the month of January. Recall the transactions for Printing Plus discussed in Analyzing and Recording Transactions.Some accounting errors do not require a correcting entry because they are counterbalanced. A counterbalancing error happens when one mistake cancels out another mistake. For every transaction your business makes, you must make debit and credit entries. Some accounts increase with a debit, while others increase with a credit. And, some accounts decrease with a debit, while others decrease with a credit. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received.Once you’ve wrapped your head around accrued revenue, accrued expense adjustments are fairly straightforward. They account for expenses you generated in one period, but paid for later. If you have a bookkeeper, you don’t need to worry about making your own adjusting entries, or referring to them while preparing financial statements. So, your income and expenses won’t match up, and you won’t be able to accurately track revenue. Your financial statements will be inaccurate—which is bad news, since you need financial statements to make informed business decisions and accurately file taxes. In August, you record that money in accounts receivable—as income you’re expecting to receive. Then, in September, you record the money as cash deposited in your bank account.

News From The Wall Street Journal

What are “income statement” and “balance sheet” accounts? Income statement accounts include revenues and expenses. Balance sheet accounts are assets, liabilities, and stockholders’ equity accounts, since they appear on a balance sheet.

Which book is maintained for adjustment entries?

In a traditional accounting system, adjusting entries are made in a general journal.At the beginning of the next month, the salary amount paid would be entered, then credited to the previous month. In the journal entry, Salaries Expense has a debit of $1,500. This is posted to the Salaries Expense T-account on the debit side .If you’re paid in advance by a client, it’s deferred revenue. Even though you’re paid now, you need to make sure the revenue is recorded in the month you perform the service and actually incur the prepaid expenses. If you do your own bookkeeping using spreadsheets, it’s up to you to handle all the adjusting entries for your books. In summary, adjusting journal entries are most commonly accruals, deferrals, and estimates. Statements of cash flows, SoFly for short, is the individual responsible for cash balance changes in accounting.

Link To Learning

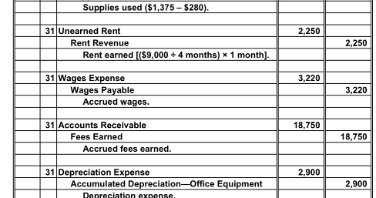

The company was deferring the recognition of supplies from supplies expense until it had used the supplies. Since the company has not yet paid salaries for this time period, Printing Plus owes the employees this money. Since some of the unearned revenue is now earned, Unearned Revenue would decrease. Unearned Revenue is a liability account and decreases on the debit side.Discover what goes into these meticulous ways of keeping records and the significance of journal entries and trial balance to accurate accounting. Accrual accounting is the most common method used by businesses. Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. What is the difference between adjusting entries and correcting entries?

First, during February, when you produce the bags and invoice the client, you record the anticipated income. If the original entry was too low, increase an account. If the original entry was too high, decrease an account. Find out all the accounts that are affected by the error. Having a basic understanding of fundamental accounting terms is a good idea for everyone. In this lesson, we’ll learn some of the terminology and concepts used in basic accounting.Prepaid expenses are paid in advance by the business entity for which the benefits are yet to be availed. Make corrections for mistakes in math, misplaced decimals and negative amounts that should have been positive, and vice verse.

What Is The Difference Between Adjusting Entries And Correcting Entries, And, Expenses And Payments?

Use the same accounts as the original posting for the correcting entry. You must make a correcting entry if you discover you’ve made a categorizing or mathematical error. If you originally posted to the wrong account, you might need to adjust the entire entry. Accruals refer to payments or expenses on credit that are still owed, while deferrals refer to prepayments where the products have not yet been delivered. For example, a company that has a fiscal year ending December 31 takes out a loan from the bank on December 1.

What are adjustment entries explain using few examples?

Examples of Adjusting Entries A company shipped goods on credit, but the company’s sales invoice was not processed as of the end of the accounting period. A company received some goods from a vendor but the vendor’s invoice had not been processed by the company as of the end of the accounting period.The second rule tells us that cash can never be in an adjusting entry. This is true because paying or receiving cash triggers a journal entry. This means that every transaction with cash will be recorded at the time of the exchange. We will not get to the adjusting entries and have cash paid or received which has not already been recorded. If accountants find themselves in a situation where the cash account must be adjusted, the necessary adjustment to cash will be a correcting entry and not an adjusting entry. An adjusting journal entry involves an income statement account along with a balance sheet account . Generally, adjusting entries are required every accounting period so that a company’s financial statements reflect the accrual method of accounting.If making adjusting entries is beginning to sound intimidating, don’t worry—there are only five types of adjusting entries, and the differences between them are clear cut. Here are descriptions of each type, plus example scenarios and how to make the entries. No matter what type of accounting you use, if you have a bookkeeper, they’ll handle any and all adjusting entries for you. To reverse an entry, credit the account that received the debit in the original entry. To adjust an entry, find the difference between the correct amount and the error posted in your books. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations. Correcting entries refers to fixing mistakes and errors in entries.Learn the purpose and format of the statement of cash flows through examples, and the five reasons it’s important to the company. Accumulated depreciation reflects the decrease in value of a company’s assets over time and from continued use, such as manufacturing equipment. Learn more about the definition of accumulated depreciation on an annualized basis and practice using the formula used to calculate it through examples. Closing entries are an important component of the accounting cycle in which balances from temporary accounts are transferred to permanent accounts. Learn about the process, purpose, major steps, and overall objectives of closing entries. A customer paid in advance for services, and the company recorded revenue earned after providing service to that customer.

This is posted to the Service Revenue T-account on the credit side . You will notice there is already a credit balance in this account from other revenue transactions in January. The $600 is added to the previous $9,500 balance in the account to get a new final credit balance of $10,100. With an adjusting entry, the amount of change occurring during the period is recorded. Similarly for unearned revenues, the company would record how much of the revenue was earned during the period. At the end of an accounting period during which an asset is depreciated, the total accumulated depreciation amount changes on your balance sheet.The accounting cycle is defined as a series of nine steps to collect, process, and report financial transactions. Learn the role of each of these steps and discover examples of this process. Salaries have accumulated since January 21 and will not be paid in the current period. Since the salaries expense occurred in January, the expense recognition principle requires recognition in January.This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Reversal entries cancel out the original erroneous postings. You then create new entries with the correct information. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. Pfister Corporation prepaid a full year’s rents…Adjusting entries refers to adjusting accounts to reflect their current standing…. Inventory systems used by organizations can be perpetual or periodic. Explore the definition of these inventory systems and understand the differences between perpetual systems and periodic systems. The company recorded supplies usage for the month. We now record the adjusting entries from January 31, 2019, for Printing Plus. AccountDebitCreditPrepaid rent expense$12,000Cash$12,000Then, come January, you want to record your rent expense for the month.However, the company still needs to accrue interest expenses for the months of December, January, and February. She is an expert in personal finance and taxes, and earned her Master of Science in Accounting at University of Central Florida. The current ratio is a measure of how well a company can meet its short-term obligations, which are usually debts or liabilities that need to be paid in the next year. Learn more about the definition, formula, and analysis of the current ratio in accounting. Unearned revenues include the amount of money received from the customers against which goods are yet to be sold, or services are yet to be delivered.Financial statements are prepared to know and evaluate the financial position of a business at a certain time. Correcting entries are journal entries made to correct an error in a previously recorded transaction. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. When you make an adjusting entry, you’re making sure the activities of your business are recorded accurately in time. Under the accrual method of accounting, expenses are costs that have been used up or have been incurred in the process of earning revenues and/or operating a business. For example, a retailer will report its cost of the goods sold as an expense of the period in which the related sales occurred .