Content

- Product Costs

- Matching Principle Example

- Accurate Reporting

- Understanding The Cash Flow Statement

- What Are The Types Of Accrual Accounts?

The revenue recognition principle is an accounting principle that requires the revenue be recognized and recorded when it is realized and earned, regardless of when the payment is made. In other words, businesses don’t have to wait to receive cash from customers to record the revenue from sales.

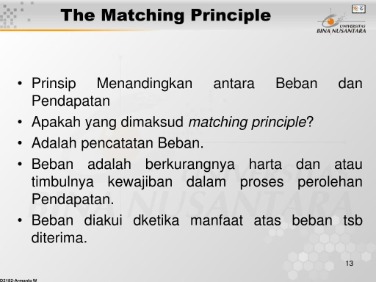

What is matching concept Why should?

The matching concept is an accounting practice whereby firms recognize revenues and their related expenses in the same accounting period. Firms report “revenues,” that is, along with the “expenses” that brought them. The purpose of the matching concept is to avoid misstating earnings for a period.Administrative salaries, for example, cannot be matched to any specific revenue stream. Depreciation is used to distribute the cost of the asset over its expected life span according to the matching principle. This matches costs to sales and therefore gives a more accurate representation of the business, but results in a temporary discrepancy between profit/loss and the cash position of the business.

Product Costs

In other words, it formally acknowledges that business must spend money in order to earn revenue. If an expense is not directly tied to revenues, the expense should be reported on the income statement in the accounting period in which it expires or is used up. If the future benefit of a cost cannot be determined, it should be charged to expense immediately. For example, consider a consulting company that provides a $5,000 service to a client on Oct. 30.For example, the entire cost of a television advertisement that is shown during the Olympics will be charged to advertising expense in the year that the ad is shown. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. A transaction is a finalized agreement between a buyer and a seller, but it can get a bit more complicated from an accounting perspective. To better understand how this concept works in the real world, imagine the following matching principle example.Under accrual accounting, firms have immediate feedback on their expected cash inflows and outflows, making it easier for businesses to manage their current resources and plan for the future. The method follows the matching principle, which says that revenues and expenses should be recognized in the same period. The matching principle is an accounting principle which states that expenses should be recognised in the same reporting period as the related revenues. This means that the machine will produce products for at least 10 years into the future. According to the matching principle, the machine cost should be matched with the revenues it creates. Thus, the machine is depreciated over its 10-year useful life instead of being fully expensed in 2015.

Matching Principle Example

Because you will continue to earn wages through the end of the month and will be paid Nov. 3, this expense needs to be recorded in the October income statement for the wages earned between Oct. 21 and Oct. 31. The primary reason why businesses adhere to the matching principle is to ensure consistency in financial statements, such as the income statement, balance sheet etc. The matching statement requires that the commission expense is reported in the December income statement. If the company uses the cash basis of accounting, the commission would be reported in January rather than December . If you do not use the matching principle, then you are using the cash method of accounting, where revenue is recorded when cash is received and expenses when they are paid. The expense must relate to the period in which they were incurred rather than on the period in which they were paid.Accrual accounting is one of two accounting methods; the other is cash accounting. Cash accounting only records the revenue when the cash transaction has occurred for the goods and services. Accrual accounting is based on the matching principle, which defines how and when businesses adjust the balance sheet. If there is no cause-and-effect relationship leading to future related revenue, then the expenses can be recorded immediately without adjusting entries. It should be mentioned though that it’s important to look at the cash flow statement in conjunction with the income statement.It should charge the cost of the equipment to depreciation expense at the rate of $10,000 per year for ten years. You purchase a bike for $200 in 2019 and it’s expected to have a lifespan of 10 years. The cost of the bike will need to be matched with the revenue it’s made you. In this case, let’s say you use it to bike to work and it’s saved you on gas. In this circumstance, you should charge the bike’s cost to the depreciation expense of $20 per year, adding up to 10 years.If, in the example above, the company reported an even bigger accounts payable obligation in February, there might not be enough cash on hand to make the payment. For this reason, investors pay close attention to the company’s cash balance and the timing of its cash flows. Prepaid expenses, such as employee wages or subcontractor fees paid out or promised, are not recognized as expenses; they are considered assets because they will provide probable future benefits.

Accurate Reporting

When businesses interpret financial statements, those statements must be calculated and prepared in a certain manner to abide by proper accounting principles. The matching principle must be utilized to better prepare documentation with accurate reporting. In this article, we define the matching principle, explain its benefits and provide examples of it in use. This method arose from the increasing complexity of business transactions and a desire for more accurate financial information. Selling on credit, and projects that provide revenue streams over a long period, affect a company’s financial condition at the time of a transaction. Therefore, it makes sense that such events should also be reflected in the financial statements during the same reporting period that these transactions occur. In other words, the revenue earned is recognized on the company’s accounting books regardless of when cash transactions have occurred.However, the accounting method is widely accepted and used by government agencies. The revenue generated by the consulting services will only be recognized under the cash method when the company receives payment. As a result, if the company uses the cash accounting method, the $5,000 in revenue would be recorded on Nov. 25, which is when the company receives the payment. A salesperson makes a 5% commission on every sale they make in the month of January, but their commission isn’t paid until February. This means that if they sell $100 worth of products in January, the company will pay them $5 in February. Despite this, the amount of commissions they earned—in this case $5—is required to be reported on the January statement with the January product sales of $100.

Is matching a valuation method?

Question: Matching is: Multiple Choice A valuation method. Ο A result of recognizing revenues and expenses that arise from the same transaction Ο (1) A cash basis reporting principle.By contrast, if the company used the cash basis of accounting rather than accrual, they would record the revenue in November and the commission in December. A cosmetics company uses sales representatives, who earn a 10% commission on their sales at the end of each month. For the month of November, the company earned $100,000 in sales, and they will pay their sales reps $10,000 in resulting commission fees in December. Liabilities are recorded on the balance sheet at the end of the accounting period. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received. The most common include accounts payable, accounts receivable, goodwill, accrued interest earned, and accrued tax liabilities.

Understanding The Cash Flow Statement

For freelancers and SMEs in the UK & Ireland, Debitoor adheres to all UK & Irish invoicing and accounting requirements and is approved by UK & Irish accountants. Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. If you recognise an expense later than is appropriate, this results in a higher net income. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.The pay period for hourly employees ends on March 28, but employees continue to earn wages through March 31, which are paid to them on April 4. The employer should record an expense in March for those wages earned from March 29 to March 31. Because of the principle, assets are equally distributed over time and matched to balance the cost.The matching principle states that expenses should be recognized and recorded when those expenses can be matched with the revenues those expenses helped to generate. In this sense, the matching principle recognizes expenses as the revenue recognition principle recognizes income. The matching principle requires that revenues and any related expenses be recognized together in the same reporting period. Thus, if there is a cause-and-effect relationship between revenue and certain expenses, then record them at the same time.

- Liabilities are recorded on the balance sheet at the end of the accounting period.

- So if the company has been operating under “cash based accounting”, they may have recorded the expense in the month of February, as it has actually paid cash in February.

- Not all costs and expenses have a cause and effect relationship with revenues.

- The expense must relate to the period in which they were incurred rather than on the period in which they were paid.

- An accrued expense is recognized on the books before it has been billed or paid.

Now if the company has 4 sales representatives and each of them secured sales of $100,000 in the first Quarter of the year, each of them earned a bonus of $1000. As there are 4 of them the total bonus expense to be paid by the company would be $4,000 (4 × $1000). Matching principle is the accounting principle that requires that the expenses incurred during a period be recorded in the same period in which the related revenues are earned.This is one of the most essential concepts in accrual basis accounting, since it mandates that the entire effect of a transaction be recorded within the same reporting period. Not all costs and expenses have a cause and effect relationship with revenues. Hence, the matching principle may require a systematic allocation of a cost to the accounting periods in which the cost is used up. Hence, if a company purchases an elaborate office system for $252,000 that will be useful for 84 months, the company should report $3,000 of depreciation expense on each of its monthly income statements. Depending on the terms of its agreement with its customers, it may take many months or years before the store receives payment in full from the customer for the refrigerator. Using the accrual accounting method, the store will record the accrued revenue from the sale when the refrigerator leaves the store, not at some date in the future.The computer is expected to last 10 years, meaning it will produce projects for the projected decade. The price of the computer should then be matched with the revenue it’s creating for the company. In this instance, the company should charge the computer’s price tag to the depreciation expense of $1,000 per year, adding up to 10 years. Imagine, for example, that a company decides to build a new office headquarters that it believes will improve worker productivity.

Julius Mansa is a CFO consultant, finance and accounting professor, investor, and U.S. Department of State Fulbright research awardee in the field of financial technology. He educates business students on topics in accounting and corporate finance. Outside of academia, Julius is a CFO consultant and financial business partner for companies that need strategic and senior-level advisory services that help grow their companies and become more profitable. The matching principle allows an asset to be distributed and matched over the course of its useful life in order to balance the cost over a given period. Sometimes store can’t collect the money and have to write off the receivable as a bad debt because it will never be collected.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. GoCardless is authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration number , for the provision of payment services. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices.On the general ledger, when the bill is paid, the accounts payable account is debited, and the cash account is credited. According to the revenue recognition principle, revenue must be recognized and recorded on the income statement when it’s earned or realized.

What Are The Types Of Accrual Accounts?

For example, if the office costs $10 million and is expected to last 10 years, the company would allocate $1 million of straight-line depreciation expense per year for 10 years. The expense will continue regardless of whether revenues are generated or not. Deferred expense allows one to match costs of products paid out and not received yet. Under a bonus plan, an employee earns a $50,000 bonus based on measurable aspects of her performance within a year. You should record the bonus expense within the year when the employee earned it. A company acquires production equipment for $100,000 that has a projected useful life of 10 years.