Content

- Indirect Cash Flow Method

- Business Class

- Why Cash Flow Analysis Is An Important Metric For Your Business

- Types Of Cash Flow

- Cash From Investing Activities

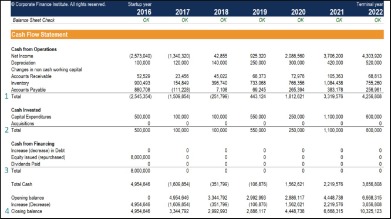

Inflows are generated by interest and dividends paid on these holdings. But the cash flow does not necessarily show all the company’s expenses. That’s because not all expenses the company accrues are paid right away. Although the company may incur liabilities, any payments toward these liabilities are not recorded as a cash outflow until the transaction occurs. Assessing the amounts, timing, and uncertainty of cash flows, along with where they originate and where they go, is one of the most important objectives of financial reporting.One of the three main components of the cash flow statement is cash flow from financing. In this context, financing concerns the borrowing, repaying, or raising of money. This could be from the issuance of shares, buying back shares, paying dividends, or borrowing cash. Financing activities can be seen in changes in non-current liabilities and in changes in equity in the change-in-equity statement. The statement of cash flows clarifies how cash was generated and how cash was used for a period of time. If you do your own bookkeeping in Excel, you can calculate cash flow statements each month based on the information on your income statements and balance sheets.It is essential for assessing a company’s liquidity, flexibility, and overall financial performance. From this CFS, we can see that the net cash flow for the 2017 fiscal year was $1,522,000. The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors. It means that core operations are generating business and that there is enough money to buy new inventory.

Indirect Cash Flow Method

This may be useful when analysts want to see how much cash can be extracted from a company without causing issues to its day to day operations. This sphere of cash flows also can be used to assess how much cash is available after meeting direct shareholder obligations and capital expenditures necessary to maintain existing capacity. Transactions that result in an increase in assets will always result in a decrease in cash flow. The three types of cash flow are cash from from operations, investing, and financing.

What is the basic purpose of a statement of financial position?

The purpose of the statement of financial position is to present true information about the company’s assets, liabilities, and equity. It helps to reveal the financial position of the company as at a particular date.Payment of dividends, payments for stock repurchases, and repayment of debt principal are included in this category. Free cash flow measures the ease with which businesses can grow and pay dividends to shareholders. Their requirement for increased financing will result in increased financing cost reducing future income. Overall, positive cash flow could mean a company has just raised cash via a stock issuance or the company borrowed money to pay its obligations, therefore avoiding late payments or even bankruptcy. Regardless, the cash flow statement is an important part of analyzing a company’s financial health, but is not the whole story. As is the case with operating and investing activities, not all financing activities impact the cash flow statement — only those that involve the exchange of cash do. For example, a company may issue a discount which is a financing expense.

Business Class

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Even if your LLC didn’t do any business last year, you may still have to file a federal tax return. As a business owner, you have many options for paying yourself, but each comes with tax implications. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.Non-cash investing and financing activities are disclosed in footnotes under IAS 7. Under GAAP, non-cash activities may be disclosed in a footnote or within the cash flow statement itself.

Why Cash Flow Analysis Is An Important Metric For Your Business

Cash flow statements are powerful financial reports, so long as they’re used in tandem with income statements and balance sheets. Use your monthly income statement, balance sheet, and visual reports to quickly access the data you need to grow your business. Spend less time wondering how your business is doing, and more time making decisions based on crystal-clear financial insights.It is the money that remains after paying for items like payroll, rent, and taxes. Cash flows from investments include money spent on purchasing securities to be held as investments such as stocks or bonds in other companies or in Treasuries.

- Cash flows also track outflows as well as inflows and categorize them with regard to the source or use.

- But these do not represent actual cash flows into the company at the time.

- This method converts accrual-basis net income into cash flow by using a series of additions and deductions.

- You don’t have to convince anyone as to the value of $10 million in cash.

- The statement of cash flows is part of the financial statements, which also include the income statement and balance sheet.

- Non-cash items show up in the changes to a company’s assets and liabilities on the balance sheet from one period to the next.

- However, when interest is paid to bondholders, the company is reducing its cash.

A positive cash flow means that more cash is coming into the company than going out, and a negative cash flow means the opposite. Non-cash investing and financing activities are disclosed in footnotes to the financial statements. General Accepted Accounting Principles , non-cash activities may be disclosed in a footnote or within the cash flow statement itself.Cash and cash equivalents include currency, petty cash, bank accounts, and other highly liquid, short-term investments. Examples of cash equivalents include commercial paper, Treasury bills, and short-term government bonds with a maturity of three months or less. Of course, not all cash flow statements look as healthy as our example or exhibit a positive cash flow. However, negative cash flow should not automatically raise a red flag without further analysis.Cash flow from operations or operating cash flow, describes money flows involved directly with the production and sale of goods from ordinary operations. CFO indicates whether or not a company has enough funds coming in to pay its bills or operating expenses. In other words, there must be more operating cash inflows than cash outflows for a company to be financially viable in the long term. Net working capital might be cash or might be the difference between current assets and current liabilities.

Types Of Cash Flow

Cash Flow from Financing Activities is cash earned or spent in the course of financing your company with loans, lines of credit, or owner’s equity. Cash Flow from Investing Activities is cash earned or spent from investments your company makes, such as purchasing equipment or investing in other companies. The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you’ve spent in theory. In corporate finance, the debt-service coverage ratio is a measurement of the cash flow available to pay current debt obligations. Knowing how to calculate FCF and analyze it helps a company with itscash managementand will provide investors with insight into a company’s financials, helping them make better investment decisions. Business activities are activities a business engages in for profit-making purposes, such as operations, investing, and financing activities.

Usually, changes in cash from investing are a “cash-out” item because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities. However, when a company divests an asset, the transaction is considered “cash-in” for calculating cash from investing. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included because it is a business activity. Creditors, on the other hand, can use the CFS to determine how much cash is available for the company to fund its operating expenses and pay down its debts. The CFS allows investors to understand how a company’s operations are running, where its money is coming from, and how money is being spent. The CFS is important since it helps investors determine whether a company is on solid financial footing. Your choice of format depends on what you intend to use your income statement for, and what level of financial detail you’re intending to provide.Receiving the money is a positive cash flow because cash is flowing into the company, while each individual payment is a negative cash flow. Issuing credit is not a financing activity though taking on credit is. Like all cash flows, such activities only appear on the cash flow statement when the exchange of money actually takes place. A financial statement that provides cash receipt and cash payment information and explains the change in cash for a period of time. In 1863, the Dowlais Iron Company had recovered from a business slump, but had no cash to invest for a new blast furnace, despite having made a profit. To explain why there were no funds to invest, the manager made a new financial statement that was called a comparison balance sheet, which showed that the company was holding too much inventory. This new financial statement was the genesis of the cash flow statement that is used today.If you check undercurrent assetson the balance sheet, that’s where you’ll find CCE. If you take the difference between the current CCE and that of the previous year or the previous quarter, you should have the same number as the number at the bottom of the statement of cash flows. The cash flow statement, which acts as a corporate checkbook that reconciles the other two statements. It shows whether all of the revenues booked on the income statement have been collected.With the indirect method, you look at the transactions recorded on your income statement, then reverse some of them in order to see your working capital. You’re selectively backtracking your income statement in order to eliminate transactions that don’t show the movement of cash.

Bench bookkeepers bring all of your account, transaction, and money info into one place and complete your monthly bookkeeping for you. Cash flows from financing are the costs of raising capital, such as shares or bonds that a company issues or any loans it takes out. Cash flow can be negative when outflows are higher than a company’s inflows. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.Cash from these activities is separate from operations because they tend to be for long-term planning and are not directly related to the day-to-day cash operations of a business. A company that consumes large amounts of cash for investment purposes indicates that it is investing for future growth, which consumes cash.When preparing the cash flow statement, one must analyze the balance sheet and income statement for the coinciding period. If the accrual basis of accounting is being utilized, accounts must be examined for their cash components. Analysts must focus on changes in account balances on the balance sheet. All of the major operating cash flows, however, are classified the same way under GAAP and IFRS.

Cash From Investing Activities

The free cash flow takes into account the consumption of capital goods and the increases required in working capital. Analysis of cash flow from investing activities focuses on ratios when assessing a company’s ability to meet future expansion requirements. It is important to note that investing activity does not concern cash from outside investors, such as bondholders or shareholders.Since it’s simpler than the direct method, many small businesses prefer this approach. Also, when using the indirect method, you do not have to go back and reconcile your statements with the direct method. However, you’ve already paid cash for the asset you’re depreciating; you record it on a monthly basis in order to see how much it costs you to have the asset each month over the course of its useful life.