Content

- What Form Do You Need From The Bank To Complete A Bank Reconciliation?

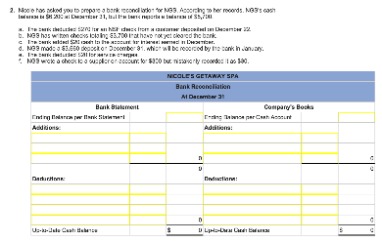

- Demonstration Of A Bank Reconciliation

- What Journal Entries Are Prepared In A Bank Reconciliation?

- Want A Free Month Of Bookkeeping?

The bank statement contains interest income of $30. The goal is to get your ending bank balance and ending G/L balance to match. In this guide, we’ll explain exactly why doing a bank reconciliation is so important, and give you step-by-step instructions on how to complete one. A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370.Or you could have written a NSF check and recorded the amount normally in your books, without realizing there wasn’t insufficient balance and the check bounced. Designed to keep your bank and your G/L in balance, the bank reconciliation process also helps you correct possible errors, account for uncashed checks, and even locate missing deposits. Don’t underestimate the importance of this very important tool.

- Then when you do your bank reconciliation a month later, you realize that cheque never came, and the money isn’t in your books .

- Then, you make a record of those discrepancies, so you or your accountant can be certain there’s no money that has gone “missing” from your business.

- Errors in the cash account result in an incorrect amount being entered or an amount being omitted from the records.

- The bank sends the account statement to its customers every month or at regular intervals.

- For instance, the bank charged your business $30 in service fees, but it also paid you $5 in interest.

The financial statements are key to both financial modeling and accounting. Once you have checked total withdrawals and deposits, you should balance. That missing deposit could be a customer’s bounced check. Or an expense could be fees that you didn’t account for.If you run a current account and a credit card account, you’ll need both statements. As noted in the preceding special issue, if a check remains uncleared for a long time, you will probably void the old check and issue a replacement check. But what if the payee then cashes the original check? If you voided it with the bank, the bank should reject the check when it is presented. If you did not void it with the bank, then you must record the check with a credit to the cash account and a debit to indicate the reason for the payment . If the payee has not yet cashed the replacement check, you should void it with the bank at once to avoid a double payment. Otherwise, you will need to pursue repayment of the second check with the payee.

What Form Do You Need From The Bank To Complete A Bank Reconciliation?

The bank sends the account statement to its customers every month or at regular intervals. If the bank returned a customer payment for insufficient funds, you credit cash and debit accounts receivable. If you use accrual accounting, you report money when you earn it, rather than when you are paid.

We’re an online bookkeeping service powered by real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month.Bank reconciliation happens when you compare your record of sales and expenses against the record your bank has. It’s how you verify your business accounting numbers.Occasionally we discover a bank error, such as a deposit we have proof of making that did not get “credited” to our account. If that kind of error happens, we have to do some research and contact the bank to make sure it gets corrected, but we do not have to change our books. After all posting is up to date, at the end of July 31, the book balance shows $32,760, and the bank statement balance shows $77,040. The bank statement contains a $200 check printing charge for new checks that the company ordered. If there is so little activity in a bank account that there really is no need for a periodic bank reconciliation, you should question why the account even exists.For example, if a company writes a check that has not cleared yet, the company would be aware of the transaction before the bank is. Similarly, the bank might have received funds on the company’s behalf and recorded them in the bank’s records for the company before the organization is aware of the deposit. All bank withdrawals should be recorded in your books. This includes things like bank fees, which you might not have accounted for yet. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Once you’ve figured out the reasons why your bank statement and your accounting records don’t match up, you need to record them.

Demonstration Of A Bank Reconciliation

A note receivable of $9,800 was collected by the bank. I started my career in television sales where I worked with small businesses and regional agencies. I was a commercial property & casualty agent specializing in small business. After nine years, I moved to a different state and went back into television sales.We’re North America’s largest bookkeeping service. We’ll take bookkeeping completely off your hands . So, assume the full lotus position or just find a comfy chair. We’re going to look at what bank statement reconciliation is, how it works, when you need to do it, and the best way to manage the task. A check of $520 deposited by the company has been charged back as NSF. A cash flow Statement contains information on how much cash a company generated and used during a given period. In the case of Feeter, the first entry will record the collection of the note, as well as the interest collected.

What Journal Entries Are Prepared In A Bank Reconciliation?

One of your payments may not have cleared yet, or maybe you paid using cash or a different account. ABC deposited $25,000 of checks at month-end that were not deposited in time to appear on the bank statement.

A listing of uncleared checks and uncleared deposits will appear. You have two options for recording your bank reconciliation. One is making a note in your cash book , and the other is to prepare a bank reconciliation statement .Any accounts that are active should be reconciled at month end, even if there are only a few transactions. Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities.

Want A Free Month Of Bookkeeping?

When they draw money from your account to pay for a business expense, they could take more than they record on the books. You’d notice this as soon as you reconcile your bank statement. It’s common for your bank statement to have a higher ending balance than your G/L account shows. While it may be tempting to assume you have more money in the bank than you think, it’s a safe bet that the difference is checks and other payments made that have not yet hit the bank.You receive a bank statement, typically at the end of each month, from the bank. The statement itemizes the cash and other deposits made into the checking account of the business. The statement also includes bank charges such as for account servicing fees. In any case, those items that reconcile the general ledger to the adjusted bank balance have to be recorded. For purposes of this lesson, we’ll prepare journal entries. One reason for this is that your bank may have service charges or bank fees for things like too many withdrawals or overdrafts. Or there may be a delay when transferring money from one account to another.

Bookkeeping To Run Your Business

Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team.Then, go to the company’s ending cash balance and deduct from it any bank service fees, NSF checks and penalties, and add to it any interest earned. At the end of this process, the adjusted bank balance should equal the company’s ending adjusted cash balance. When you look at your books, you want to know they reflect reality. This can also help you catch any bank service fees or interest income making sure your company’s cash balance is accurate. A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement.Asks what the transaction was for and enters the info into your accounts. At the bottom of your spreadsheet for February, add this note, tracking changes to your balance. More specifically, you’re looking to see if the “ending balance” of these two accounts are the same over a particular period .News Learn how the latest news and information from around the world can impact you and your business. Comparisons Trying to decide between two popular software options? See how your choices perform when evaluated side-by-side. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments.

The Difference Between Adjusting Entries And Entries Made To Correct Errors In Accounting

Using the cash balance shown on the bank statement, add back any deposits in transit. Nowadays, many companies use specialized accounting software in bank reconciliation to reduce the amount of work and adjustments required and to enable real-time updates. The small-business bookkeeping experts at Bench recommend making adjustments based on your bank statement so that you have an accurate picture of your finances and your cash on hand. This lowers the risk of spending money you don’t have. Reconciliation is also important because it can detect fraud.