Content

- How Long To Keep Business Tax Records And Receipts

- What Receipts To Save For Taxes: Dos & Donts

- How Wellybox Helps Keep Records Of Receipts For Taxes

- Are Motor Vehicle Running Costs Tax Deductible?

- The Eight Small Business Record Keeping Rules

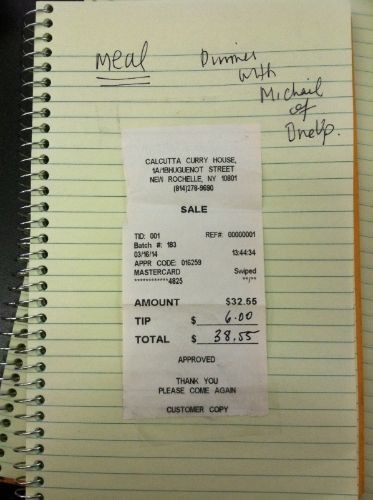

Take some expert advice on what receipts to keep for business taxes. Although many people keep paper records, it’s also smart to have the documents converted to electronic files and stored in the cloud. Finally, remember that your state may have separate rules for keeping records; check with your accountant or state tax department. Keep records for seven years if you file a claim for a loss from worthless securities or bad-debt deduction.Review which receipts to keep for taxes — the information below will help to make tax preparation less painful and ensure you take all of your eligible deductions. Saving all those receipts and financial records may be a hassle, but being able to defend your deductions in the event of an audit is well worth it. Now that you know to keep both the credit card statements and the receipts here’s a more detailed look at the various types of expenses for which you will need to document.The law also eliminated or changed the rules for, a number of tax deductions that you were able to take in 2017. On the other hand, the TCJA no longer limits overall itemized deductions according to your adjusted gross income , which is at least one positive change for itemizers. If you struggle to remember which receipts need stored for your tax records, Wellybox can help.If you donate merchandise, obtain a receipt showing the date of your donation and write in a general description of the items you donated. To determine the value of your donation, consult one of the online guides produced by charities such as Goodwill or Salvation Army for this purpose. There are numerous deductions available when you look at the instructions for IRS Form 1040, but some are much more common than others.

How Long To Keep Business Tax Records And Receipts

We encourage you to view the IRS website for more details on federal tax deductions and credits. Many people often ask if they really need to keep all of their receipts for taxes, and the short answer is yes. If you plan to deduct that expense from your gross income, you need to have proof that you made the purchase. Though keeping your receipts is a tedious project at best, it is necessary for many business owners.

Do I need to keep grocery receipts for taxes?

Do You Need to Save Your Receipts for Taxes? Many people often ask if they really need to keep all of their receipts for taxes, and the short answer is yes. If you plan to deduct that expense from your gross income, you need to have proof that you made the purchase.For instance, it might be wise to save W-2 forms until you start receiving Social Security benefits so you can verify your income if there’s a problem. When you sell any business assets — such as the real estate, furniture or machinery you use — you’ll need to keep the purchase and sales agreements as well as your receipts. You’ll also need the purchase receipts if you use depreciation on your business assets as tax write-offs.

What Receipts To Save For Taxes: Dos & Donts

Know where unemployment compensation is taxable and where it isn’t. Nordstrom and other luxury stores have been targets of a series of high-profile lootings in in the Union Square shopping area of San Francisco. You can also manage your communication preferences by updating your account at anytime. You’ll start receiving the latest news, benefits, events, and programs related to AARP’s mission to empower people to choose how they live as they age. There’s nothing wrong with saving your records longer than the legal limits if it gives you peace of mind and you can stand the clutter. You might consider storing some records in the cloud — remote computer storage space that you rent.No matter how small the business purchase may be, it can add up to a huge tax deduction. Therefore, you need to keep all records related to business income and expenses. These may include a multitude of things and tend to vary based on the nature of your business. We recommend that you research common business expenses in your industry for more accurate information. Sometimes your stock picks don’t turn out so well, or you loan money to your deadbeat brother-in-law who can’t pay you back. If that’s the case, you might be able to write off any your worthless securities or bad debts.However, you don’t have to spend a lot of money to get a secure app with top-notch features. Even with the federal exemption from death taxes raised, retirees should pay more attention to estate taxes and inheritance taxes levied by states. You can also find a ready-made receipt organizer or even use your tech savvy to operate a receipt scanner. No matter which tax receipt organization style suits you, arrange your documents by year and category. And given smartphones and easily accessible file hosting services such as Dropbox, this solution is more practical than ever. Investopedia requires writers to use primary sources to support their work.Secure cloud storage services like Dropbox, Evernote, or Google Drive. Go paperless, store everything electronically, and always make backups. In order to fetch your email receipts, WellyBox requires View access to your inbox.

How Wellybox Helps Keep Records Of Receipts For Taxes

For example, was that $35.67 you spent at Wal Mart for office supplies for your business, or was it for groceries? The six-year rule also applies if you have substantially overstated the cost of property to minimize your taxable gain. Say if you sold a piece of property for $150,000 and claimed you paid $125,000 instead of the actual $50,000, the IRS has six years to take action against you. And if you have omitted more than $5,000 in income from an offshore account, the statute of limitations is also six years. A mortgage interest deduction allows homeowners to deduct mortgage interest from taxable income. Under the TCJA, the 2%-of-AGI threshold no longer applies, but you can no longer deduct the following. A portion of money you pay for long-term care insurance can also minimize your tax burden.After you file, be sure to keep copies of your tax return and related records in a secure place in case there are questions about your return, how much tax you owe, or the amount of your refund. And just saving the credit card or bank statement does not show what was purchased.And if you’ve sold a rental property, you’ll need detailed records of the amount you’ve invested in the property over the years, as well as how much you deducted for depreciation. It’s wise to keep Schedule E, the form you fill out every year for rental income, as long as you own the property. The same goes for an RV or boat—check the registration paperwork to see if you are paying property taxes on those, too, and keep in mind the $10,000 cap on total SALT taxes. And by tax time, the ink has likely rubbed off the paper — which might be little more than torn pocket lint by that point anyway.

This is really just another benefit to keeping digital records. Instead of worrying whether you should be keeping or getting rid of them, you can archive them permanently. We recommend scanning every record and receipt in your business, tagging it with a descriptive name, and archiving it forever.Obtain an amortization statement showing how much of each mortgage payment goes toward interest and how much pays down the principal of the mortgage. The amortization statement, together with your cancelled checks, provides sufficient proof of your payments. Also keep copies of insurance and tax bills, along with the canceled checks showing you paid these items. Keeper Tax automatically finds tax deductions among your purchases. On average, people discover write-offs worth $1,249 in 90 seconds. Your Bench subscription includes unlimited document storage, which means you can keep every receipt, invoice, or IOU in the same place as your bookkeeping.

Are Motor Vehicle Running Costs Tax Deductible?

Each month, your Bench bookkeeper matches uploaded documents to their exact transaction—if you need to reference that receipt later, it’s just a quick search away. At year-end, your CPA or tax professional can review your documents and completed financial reports side-by-side, making tax filing a breeze. Say you dispose of a property by selling it during the 2018 tax year, report the financial gain on your 2020 tax return, and file your tax return right on the tax deadline of April 17, 2021. That means you’d need to keep records connected to the property until April 17, 2024 (i.e. three years after the filing date of April 17, 2021).

Rather than searching through your inbox manually, you can let Wellybox scan every company email for records. You can also digitize any paper receipts so that you can gather every document in one place. The top receipt tracker apps aren’t limited to storing digital receipts. For example, you can digitize any paper receipts directly through the Wellybox app. The best way is by simply take a photo of the receipt and it gets uploaded to your cloud.Consult the IRS list of legitimate medical deductions for items you might overlook. Generally, save receipts if they document a deduction or credit on a tax return. The IRS is legally required to accept digital forms of proof for your write-offs, including bank and credit card statements. Since the IRS encourages you to keep records for so long, online storage becomes even more crucial. If you only keep paper receipts in a filing cabinet, then you risk losing them at some point. Should you ever get audited, you could find yourself struggling to provide evidence for your deductions. The IRS has up to six years to initiate an audit if you’ve neglected to report at least 25% of your income.

- In fact, the IRS’s definition of medical expenses is fairly broad and can include such items as acupuncture and smoking-cessation programs.

- To support a deduction, you will need to show what you purchased, when it was purchased, where or from whom it was purchased, and how much was spent.

- You should keep copies of your tax returns, and all supporting documentation.

- The modified adjusted gross income you report on your tax return is used to determine if you qualify for certain tax benefits.

- These include business deductions if you’re self-employed, such as business travel, office supplies, the cost of maintaining a home office if you have one and other equipment.

- You donated your skinny jeans and wagon-wheel coffee table to Goodwill which in turn reduced your taxes by increasing your charitable deductions.

Save 25% when you join AARP and enroll in Automatic Renewal for first year. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace.

What Receipts Do You Need To Keep For Your Tax Return?

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. If you have a self-only high-deductible health plan , you can contribute up to $3,600 to an HSA in 2021; if you have a family HDHP, you can contribute up to $7,200 in 2021. Individuals can elect to deduct donations of up to 100% of their 2020 AGI (up from 60% typically).

What Kind Of Tax Deductions Are For A Single Person With No Dependents & No House?

For instance, the California Franchise Tax Board has up to four years to audit state income tax returns, so California residents should save related documents for at least that long. How to file receipts for taxes, consider seeking the help of a tax professional. They can not only tell you what receipts to keep for taxes, but they can also assist taxpayers with complex financial situations and can help with calculating all types of taxes. Concerning the money you receive back, this could also help protect any tax refund. But rather than focusing on how to spend or what not to do with a refund, a tax expert can use receipts to help you avoid needing a refund in the first place.