Content

- Revenue Recognition Practices

- Applying Cash Accounting

- Revenue Recognition Principle

- Terms Similar To The Revenue Recognition Principle

- How Does Using The Revenue Recognition Principle Help My Business?

This is a form of cash basis accounting and is most commonly found in installment sales. The revenue recognition principle is a key component of accrual-basis accounting. This accounting method recognizes the revenue once it is considered earned, unlike the alternative cash-basis accounting, which recognizes revenue at the time cash is received. In the case of cash-basis accounting, the revenue recognition principle is not applicable. In essence, revenue recognition looks to answer when a business has actually earned its money. Typically, revenue is recognized after the performance obligations are considered fulfilled, and the dollar amount is easily measurable to the company.

However, in June 2020, the FASB deferred the effective date for nonpublic entities that had not yet issued, or made available for issuance, their financial statements reflecting the adoption of the standard. For those entities, they may elect to adopt the standard for annual reporting periods beginning after December 15, 2019 and interim reporting periods within annual reporting periods beginning after December 15, 2020. The IASB made its standards listed in IFRS 15 effective financial statements issued on or after 1 January 2018. From a strictly legal perspective, private companies are not required to comply with GAAP standards in the U.S. However, from a more de facto point of view, companies may need to comply with revenue recognition requirements for many reasons.

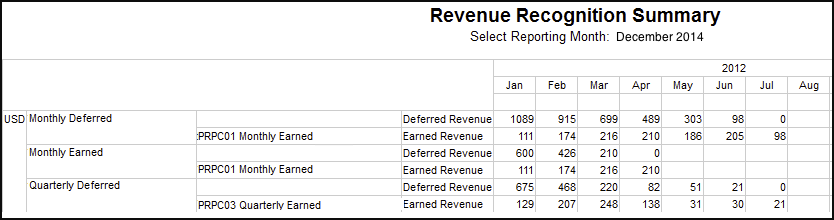

Revenue Recognition Practices

The matching principle, part of accrual accounting, requires that expenses be recognized when obligations are incurred , and that they offset recognized revenues, which were generated from those expenses. Consider the scenario where a clothing retailer records revenue after a customer pays for a new pair of jeans.A monthly magazine receives 1,000 subscriptions of $240 to be paid at the beginning of the year. Each month it recognizes revenue worth $20,000 [($240 ÷ 12) × 1,000]. Following the aforementioned process often results in recognition of revenue proportionate to the goods delivered and/or services performed.In June, $90,000 was collected and in September, $210,000 was collected. AccountDRCRAccounts Receivable$3,077Service Revenue$3,077Record monthly revenue earned on 13-month contract. AccountDRCRDeferred Revenue$2,000Service Revenue$2,000Record onboarding fee revenue earned on 12-month contract.The firm divides the entire job into various stages of completion and recognizes revenue as soon as a stage of the job is complete. Completed service contract method in which a firm recognizes revenue only when the whole rendering of services is complete.

How does revenue recognition affect financial statements?

According to the Financial Accounting Standards Board (FASB), the purpose of revenue recognition is “to report useful information to users of financial statements about the nature, amount, timing, and uncertainty of revenue from contracts with customers.”The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle. They both determine the accounting period in which revenues and expenses are recognized. According to the principle, revenues are recognized when they are realized or realizable, and are earned , no matter when cash is received. In cash accounting – in contrast – revenues are recognized when cash is received no matter when goods or services are sold. According to the principle, revenues are recognized if they are realized or realizable . Revenues must also be earned , regardless of when cash is received.

Applying Cash Accounting

The revenue recognition principle using accrual accounting requires that revenues are recognized when realized and earned–not when cash is received. The last exception to the revenue recognition principle is companies that recognize revenue when the cash is actually received.

- AccountDRCRDeferred Revenue$2,000Service Revenue$2,000Record onboarding fee revenue earned on 12-month contract.

- The accounting principle regarding revenue recognition states that revenues are recognized when they are earned and realized or realizable .

- In fixed-price contracts, the contractor/builder agrees to a price before construction actually begins.

- Public companies within the U.S. are required to follow GAAP standards.

- ASC 606 provides a uniform framework for recognizing revenue from contracts with customers.

- It is critical for businesses to look strategically at revenue recognition policies to ensure they are compliant now and are conducive to the company’s future financing, filing and expansion goals.

If there is substantial doubt that anypayment will be received, then the company should not recognize any revenue until a payment is received. The revenue recognition principle, or just revenue principle, tells businesses when they should record their earned revenue. For larger purchases where a customer pays through installments—like a mortgage, for example—companies should only recognize revenue once the payment has been received. Revenue for service-based work like consulting is recognized at the time of consulting even if client pays at a later time.

Revenue Recognition Principle

Once the initial process is complete (i.e., the consumer has completed the questionnaire, the company has created a curated plan and the pour-over coffee maker has been delivered), that $50 can be recognized. The recurring fee, however, is charged on the first of each month even though the coffee itself is not delivered until mid-month. The company cannot recognize that $25 recurring payment when they receive it, as the business has not technically earned it yet. The revenue recognition principle enables your business to show profit and loss accurately, since you will be recording revenue when it is earned, not when it is received.

Revenue recognition has been a hot topic for the past several years in light of the release of Accounting Standards Codification 606 in 2014. If you have doubts about the collectability of an invoice, it should not be recognized as revenue.

Terms Similar To The Revenue Recognition Principle

Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Particularly for long-term manufacturing or construction projects, revenue is often recognized at different stages throughout the production process. Usually revenue is recognized at fixed milestones, based on progress towards completion. So how do you know when to record your revenue, then, if it’s different for every business? To help you out, we’ve put together some revenue recognition examples that show how revenue should be realized for businesses of all kinds.

How do you find a company’s revenue?

The most simple formula for calculating revenue is: Number of units sold x average price.Alternatives Looking for a different set of features or lower price point? Check out these alternative options for popular software solutions. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. ProfitWell can improve revenue performance by providing metrics, reducing churn, and much more.So if a company enters into a transaction to sell inventory to a customer, the revenue is realizable. In this case, the retailer would not earn the revenue until it transfers the ownership of the inventory to the customer. The problem with SaaS is that the subscription business model falls between the gaps of GAAP. There aren’t any specific revenue recognition standards for SaaS businesses. Company B still has to earn their revenue, even though the customer has already paid for the whole year in advance. For a seller using the cash method, revenue on the sale is not recognized until payment is collected and expenses are not recorded until cash is paid. For companies that don’t follow accrual accounting and use the cash -basis instead, revenue is only recognized when cash is received.Independent contractors also face a perplexing accounting situation, because when they are paid often varies. QuickBooks Online is the browser-based version of the popular desktop accounting application. It has extensive reporting functions, multi-user plans and an intuitive interface. This is to record the January payment since it has now been earned. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.Net realizable value is the value of an asset that can be realized upon its sale, minus a reasonable estimation of the costs involved in selling it. Revenues from rendering services are recognized when services are completed and billed. For the sale of goods, IFRS standards do not permit revenue recognition prior to delivery. Failure to record and understand the ASC 606 impact of these entries could result in a company overstating liabilities and understating revenue. To ensure accurate financial reporting, leadership must take action on these knowledge gaps by either training staff, outsourcing, or investing in high-performing employees. Free service doesn’t mean no revenue is earned; it means that the total transaction price would be reallocated to incorporate the additional months.

Exceptions To Revenue Recognition Principle

You’ve just landed the biggest customer in your SaaS company’s history, adding tens of thousands of dollars to your income in a single sale. There is a reasonable level of assurance regarding the collection of cash payment. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. A contingent asset is a potential economic benefit that is dependent on future events out of a company’s control.Using this principle also helps you better account for revenue in the period that it’s earned, rather than the period in which it’s received. Companies don’t need to wait until payment is collected to record it as revenue. This is a key concept in accrual basis accounting, and usually applies to service-based businesses like consultancies.To the percentage of completion method, the completed contract method only allows revenue recognition when the contract is completed. For example, if a company cannot reliably estimate the future warranty costs on a specific product, the criteria are not met. When the fifth criterion is met, at that point revenue may be recognized. If your company gave a client one additional month of free consulting services, the $40,000 consulting fees would be allocated over 13 months instead of 12 months, even though no payment is received. The agency completes and delivers the website in the first month, leading to a ledger update – even if they have not been technically paid by the client yet. As soon as it’s delivered, the performance obligation is considered fulfilled.